There’s a one-in-five chance that over the next 30 years the U.S. market will suffer a 20%-plus single-day plunge

The Dow Jones Industrial Average lost almost 23% on Oct. 19, 1987. Getty Images

Thirty-six years ago, on Oct. 19, 1987, the U.S. stock market suffered its worst crash ever. That day, the Dow Jones Industrial Average DJIA lost 22.6%.

The good news is that the odds are extremely low that U.S. stocks in the next several months will experience a comparable single-session decline.

The bad news is that those odds aren’t zero. Though the odds on any given day are low, chances are high that a drop of such magnitude will take place someday. Investors need to take those odds into account as they devise portfolio strategies, either on their own or with a financial adviser’s help.

We know the odds of a crash because researchers several years ago derived a formula that successfully predicts the average frequency of stock market crashes over long periods of time.

According to that formula, there’s a one-in-five chance that over the next 30 years the U.S. market will see another 22.6% one-day drop.

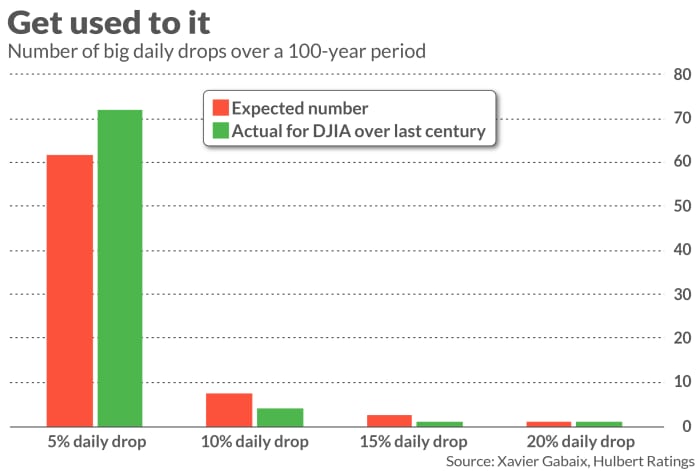

One way of judging the researchers’ formula is by comparing the Dow Jones Industrial Average’s big drops over the past century with what that formula would have predicted. As you can see from the chart below, the formula has done an impressive job.

Insuring against a crash

To be sure, the researchers’ formula doesn’t predict when crashes will occur, only their frequency over long periods of time. You might think that means you can’t plan for them. But that isn’t so, according to Nassim Taleb, a professor of Risk Engineering at New York University.

In his well-known book “Black Swan: The Impact of the Highly Improbable,” Taleb in effect argues that we’re wrong to think that daily stock market changes neatly fall into a bell-shaped or “normal” distribution, with most of those changes being minor (the hump in the middle of the bell) and a few big gains and a few big losses in the right and left tails of that distribution. Instead, the left side of that distribution is fatter than expected; that fat tail contains what Taleb refers to as “Black Swans.”

Because stock market gains and losses don’t adhere to a normal distribution, both investors and financial advisers are mistaken in thinking they can simply lower clients’ portfolio risk and proportionally reduce their returns. Instead, an “average” risk portfolio will have below-average performance.

Taleb writes: “[B]ecause of the Black Swan, [your strategy should be] … as hyper-conservative and hyper-aggressive as you can be instead of being mildly aggressive or conservative. Instead of putting your money in “medium risk” investments… , you need to put a portion, say 85 to 90 percent, in extremely safe instruments, like Treasury bills. … The remaining 10 to 15 percent you put in extremely speculative bets, as leveraged as possible (like options).”

To illustrate, imagine allocating 90% of your portfolio to one-year U.S. Treasury bills BX:TMUBMUSD01Y and buying one-year call options on the S&P 500 SPX with the remaining 10%. Since T-Bills currently yield more than 5%, you will not lose money over the next year even if the call options expire worthless. If instead the S&P 500 rises enough to pay for the option’s premium, you will turn a profit. And if the stock market skyrockets, you will realize an outsized return.

That’s just one example. Another possibility is to substantially invest in equities and allocate the remainder to S&P 500 put options. Regardless, you will definitely sleep better for it.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

“But the odds are not zero”,hmmmmmm……,reminds me of something,wait for it!

What BS. Surprised our Admin would publish such garbage from one of the kings of MSM – CBS. They have been behind the monopoly money push to enrich Corp media and everything related that will imprison us.

buy gold

Ladies and Germs, get your sachwerte while the getting is good. It was better yesterday than today and better today than tomorrow. The brilliant Austrian School of Economics calls for “escape to things of value” when the money is going to crap. “Flucht in die sachwerte.”

Also known as uncommon…common sense…that is why most will not escape…

“Over the next 30 years” ? I’m hoping it’ll crash within the next 30 days – and more than 25%.

I am going to be laughing hysterically if we get a Black Monday in two days.

Yellen predicted a soft landing, and has consistently been wrong, so prepare.for one hell of a crash.

.

Talk about making a meaningless, empty prediction. Worthless journalism at its best.

What are the odds of dying each day?

Pffffftttt….just like 1929 , the stock market will crash when Deep Shekels needs it to crash and not a minute sooner.

Franklin Delano

Roosevelt FDR My Exploited Father In

Law ( 1970)

Dall, Curtis B

The Democratic politicians who were looking for a “target” in

Washington pointed their finger at President Herbert Hoover. The

crash was his fault! He was the goat; certainly not the One-World

Bankers with their curtailment of credit and their short selling,

performed by well rewarded “fronts.”

The World-Money managers had figured in mid-1929 it

was time to cause a change in the Administration in 1932. They

saw to it that “recovery” from the Crash was delayed until after the

Inauguration of their candidate, President Franklin D. Roosevelt, in

1933 to make the most profit financially and politically.

https://archive.org/details/DallCurtisB.FranklinDelanoRooseveltFDRMyExploitedFatherInLaw1970

And this guy did not kill himself.

Argentina’s far-right firebrand Javier Milei is the one to beat in a wide-open presidential race

The first-round presidential vote follows a shock primary win for far-right frontrunner Javier Milei, a libertarian outsider who has pledged to dollarize the economy, abolish the country’s central bank, and sharply reduce state spending.

https://www.cnbc.com/2023/10/20/argentina-election-javier-milei-seen-as-the-one-to-beat-in-open-race.html

My thoughts as well. All the World’s A Stage.

1987 was a blip, what is coming is much closer to 1929.

Probably closer to the Black Plague in Europe, without the disease.,

Hoping it comes in October. I’ve taken some short positions with my fiat dollars after that politicians were doing the same. I’m up but expect to make 30% or more on it.