Guest Post by Jesse

“It rubs the lotion on its skin, or else it gets the hose again.”

Buffalo Bill, The Silence of the Lambs

“Fed officials want to start raising the cost of your borrowing because they worry they’ve been giving you a free ride for too long with zero interest rates. We listen to Fed officials all of the time here at The Wall Street Journal, and they just can’t figure you out.”

Jon Hilsenrath, The Wall Street Journal

I see where Ben Bernanke is worried that the US is losing economic control of the world, and is dismayed at the prospect of ‘competing systems’ with the rise of an alternative development bank and currency regime led by the BRICS.

And the Fed’s friendly financial journalist mouthpiece Jon Hilsenrath asks why you are being so stubborn and stingy, and not out there spending. Are you being awkward or something?

You see, the Fed looks at the aggregate numbers, and from what they can tell from their models, people are saving just too darn much.

Perhaps if they paid more attention to median numbers and the broader public, they would see the skew in the distribution of income gains that have gained even greater momentum under their top down monetary regimes. And then they would know that the one percent has plenty of excess income and capital gains from the bubble in paper assets. And why Jamie Dimon just joined the ranks of the billionaires, while the median income continues to stagnate.

A glassblower’s shop. A used-furniture store. Luxury high-rise condos protected by double fences and electric wire. Neighborhood bars. Fancy restaurants. Sushi. Pizza. Bold glass office buildings.

The Itaim Bibi neighborhood of São Paulo seems to have been spared the zoners’ boring prescriptions. Offices, houses, shops all mingle promiscuously. A small house – modest, cheap, built in the 1950s – sits across from our hotel. It’s forgotten by time, surrounded by the commerce of the 21st century.

Another house on the Rua Floriano sits underneath an office complex. The owners refused to sell. So the developers built a huge, slick office tower right over it.

“It’s a great city,” says a colleague. “There are only a handful of cities like this in the world. London, Shanghai, Mumbai, Beijing. Paris is a small town in comparison.”

Little by little, we’re beginning to find our way around. But we’re not here for our own amusement. We’re not just drinking caipirinhas and ogling the Paulistas. No, that would be selfish. We’re here on your behalf, to learn. To study. To try to understand how this economy works.

It’s just a coincidence that it’s summer here. And that this weekend it’s Carnaval. And that we have a ticket to Rio in our pocket.

Photo credit: victorpalmer

Our subject lately has been debt. Paul Krugman says no one understands it. He proved his point in a recent New York Times column; at least he proved that he has no idea of how it works.

“We owe it to ourselves,” he wrote. That suggests that the net impact of debt is zero. But is it?

Continue reading “The First Casualty as Debt Implodes Will Be …”

“There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.” – Ludwig von Mises

The surreal nature of this world as we enter 2015 feels like being trapped in a Fellini movie. The .1% party like it’s 1999, central bankers not only don’t take away the punch bowl – they spike it with 200 proof grain alcohol, the purveyors of propaganda in the mainstream media encourage the party to reach Caligula orgy levels, the captured political class and their government apparatchiks propagate manipulated and massaged economic data to convince the masses their standard of living isn’t really deteriorating, and the entire façade is supposedly validated by all-time highs in the stock market. It’s nothing but mass delusion perpetuated by the issuance of prodigious amounts of debt by central bankers around the globe. And nowhere has the obliteration of a currency through money printing been more flagrant than in the land of the setting sun – Japan. The leaders of this former economic juggernaut have chosen to commit hara-kiri on behalf of the Japanese people, while enriching the elite, insiders, bankers, and their global banking co-conspirators.

Japan is just the point of the global debt spear in a world gone mad. Total world debt, excluding financial firms, now exceeds $100 trillion. The worldwide banking syndicate has an additional $130 trillion of debt on their insolvent books. As if this wasn’t enough, there are over $700 trillion of derivatives of mass destruction layered on top in this pyramid of debt. Just five Too Big To Trust Wall Street banks control 95% of the $302 trillion U.S. derivatives market. The reason Jamie Dimon and the rest of the leaders of the Wall Street criminal syndicate commanded their politician puppets in Congress to reverse the Dodd Frank rule on separating derivatives trading from normal bank lending is because these high stakes gamblers want to shift their future losses onto the backs of middle class taxpayers – again. The bankers, with the full support of their captured Washington politicians, will abscond with the deposits of the people to pay for their system destroying risk taking, just as they did in 2008 by holding taxpayers hostage for a $700 billion bailout.

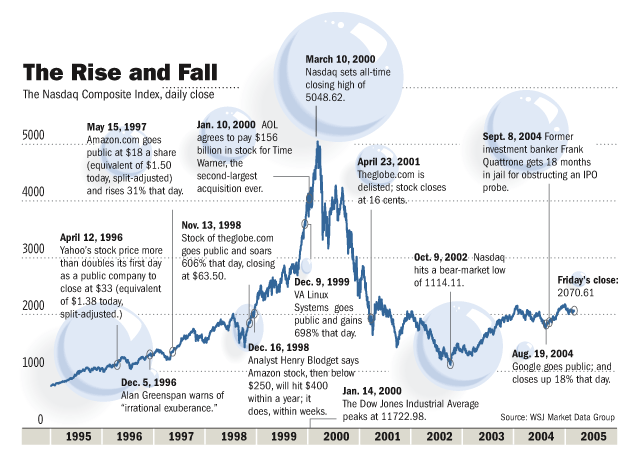

Only the ignorant, intellectually dishonest, employees of the Deep State, CNBC cheerleaders for the oligarchy, or Ivy League educated Keynesian loving economists choose to be willfully ignorant regarding the true cause of the 2008 implosion of the worldwide financial system. The immense expansion of credit in the U.S. from 2000 through 2008 was created, encouraged, supported and sustained by Alan Greenspan, Ben Bernanke and their cohorts at the Federal Reserve through their reckless lowering of interest rates and abdication of regulatory oversight, as their owner banks committed the greatest financial control fraud in world history. Total credit market debt in the U.S. grew from $25 trillion in 2000 (already up 100% from $12.5 trillion in 1990) to $53 trillion by 2008.

The bankers, politicians, mainstream media corporations, and mega-corporations that run the show lured Americans into increasing their credit card, auto loan, and student loan debt from $1.6 trillion in 2000 to $2.7 trillion in 2008, while extracting over $600 billion of phantom home equity from their McMansions. And it was all spent on things they didn’t need, produced in Chinese slave labor factories. The mal-investment boom was epic and the collapse in 2008 would have purged the bad debt, punished the risk takers, bankrupted the criminal banks, reset the financial system, and taught generations a lesson they needed to learn – excess debt kills. Instead of voluntarily abandoning the madness of never ending credit expansion and accepting the consequences of their folly, the world’s central bankers and captured politician hacks chose to save bankers, billionaires, and the ruling elite at the expense of the common people.

The false storyline of government austerity continues to be peddled to the public, but is nothing but pablum served to the mentally infantile masses, while the criminals continue to manufacture debt out of thin air, pillage the wealth of the working class, gamble recklessly knowing it’s with taxpayer funds, debase their currencies in an effort to make their debts easier to service, and enrich themselves and their cohorts, while impoverishing the little people. Consumer credit card debt peaked at $1.02 trillion in mid-2008. After hundreds of billions in bad debt write-offs by the Wall Street banks and shifted to the taxpayer, the American consumer has purposefully avoided running up credit card debt on Chinese produced crap, despite the urging of bankers, the mainstream media and politicians to revive our warped, debt laden, consumption dependent economy. Credit card debt is currently $140 billion BELOW levels in 2008, despite the never ending propaganda about an economic and jobs recovery. The fake Wall Street created housing recovery is confirmed by the fact mortgage debt outstanding is $1.4 trillion LOWER than 2008 heights and mortgage applications are hovering at 1999 levels.

Where Americans were in control and understood the consequences of their actions, they willingly reduced their debt based consumption. This was unacceptable to the powers that be at the Federal Reserve, in the banking sector, consumption dependent mega-corporations, and their government puppets on a string. The government took complete control of the student loan market and used their ownership of the largest auto lender – Ally Financial (aka GMAC, aka Ditech, aka Rescap) to dole out subprime auto loans and subprime student loans at a prodigious rate. The Wall Street banks joined the party, with assurance from Yellen and the Obama administration their future losses would be covered.

The Greenspan/Bernanke/Yellen Put lives on. So, while credit card debt is 14% below 2008 levels, student loan and auto loan debt has soared by 47%, up $769 billion from its early 2010 lows. The Fed and their government minions have desperately accelerated their credit expansion in a futile effort to revive our moribund, debt saturated, welfare/warfare empire of delusion. After temporarily plateauing at $52 trillion in 2010, the acceleration of consumer credit, issuance of corporate debt to fund stock buybacks, and of course the $5 trillion added to the National Debt by Obama, have driven total credit market debt to an all-time high of $58 trillion. In addition, the Fed expanded their balance sheet by $3.6 trillion through their various QE schemes, funneling the interest free funds to their Wall Street owners to create the illusion of economic recovery through a stock market surge. The .1% never had it so good.

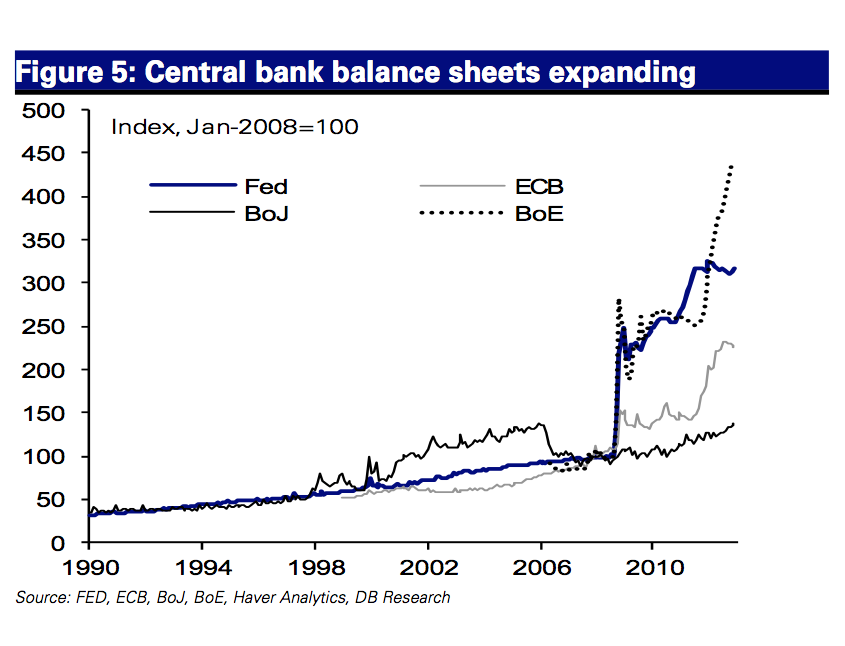

Of course, the U.S. has not been alone in attempting to cure a disease caused by excessive debt by issuing trillions in new debt. It is clear to anyone not in the employ of the Deep State that central bankers in the U.S. are working in concert with central bankers in Europe and Japan to keep this farcical Keynesian nightmare from imploding under an avalanche of deflation, wealth destruction, chaos and retribution for the guilty. The Federal Reserve used every means at their disposal to hide the fact they bought over $400 billion of mortgage backed securities from European banks and in excess of $1.5 trillion of their QE benefited foreign banks. It was no coincidence that one day after the Fed ended QE3, the Bank of Japan announced a massive “surprise” increase in purchases of bonds and stocks. It wasn’t a surprise to Janet Yellen, as this was the plan to keep stock markets rising, record Wall Street bonuses being paid, and further enrichment of the .1% global elite. The Japanese stock market has surged 18% since the October 31 announcement, with the U.S. market up 10%. Now it is time for Draghi to pick up the baton and create another trillion or two to support the lifestyles of the rich and famous. Central bankers know who they really work for, and it’s not you.

With global worldwide debt now exceeding $230 trillion we have far surpassed the point of no return. There is no mathematical possibility this debt will ever be repaid. And this doesn’t even include the hundreds of trillions of unfunded liability promises made by corrupt politicians around the world. The level of total global debt to global GDP, at nosebleed levels of 210% in 2008, has escalated past 240% as central bankers push the world towards a final and total catastrophe. With U.S. credit market debt of $58 trillion and GDP of $17.6 trillion, the U.S. is a basket case at 330%. The UK, Sweden and Canada are on par with the U.S.

But Japan takes the cake with total debt to GDP exceeding 500% and headed higher by the second. Their 25 year Keynesian experiment by mad central bankers and politicians enters its final phase of currency failure. Negative real interest rates, trillions wasted on worthless stimulus programs, and currency debasement have failed miserably, so Abe’s solution has been to double down and accelerate failed solutions. Only an Austrian economist can appreciate the foolishness of such a reckless act.

“Credit expansion is the governments’ foremost tool in their struggle against the market economy. In their hands it is the magic wand designed to conjure away the scarcity of capital goods, to lower the rate of interest or to abolish it altogether, to finance lavish government spending, to expropriate the capitalists, to contrive everlasting booms, and to make everybody prosperous. – Ludwig von Mises

Guest Post by Walter E. Williams

So as to give some perspective, I’m going to ask readers for their guesses about human behavior before explaining my embarrassment by some of my fellow economists.

Suppose the prices of ladies jewelry rose by 100 percent. What would you predict would happen to sales? What about a 25 or 50 percent price increase? I’m going to guess that the average person would predict that sales would fall.

Would you make the same prediction about auto sales if cars’ prices rose by 100 percent or 25 or 50 percent? Suppose that you’re the CEO of General Motors and your sales manager tells you the company could increase auto sales by advertising a 100 percent or 50 percent price increase. I’m guessing that you’d fire the sales manager for both lunacy and incompetency.

Let’s try one more. What would you predict would happen to housing sales if prices rose by 50 percent? I’m guessing you’d predict a decline in sales. You say, “OK, Williams, you’re really trying our patience with these obvious questions. What’s your point?”

It turns out that there’s a law in economics known as the first fundamental law of demand, to which there are no known real-world exceptions. The law states that the higher the price of something the less people will take of it and vice versa. Another way of stating this very simple law is: There exists a price whereby people can be induced to take more of something, and there exists a price whereby people will take less of something.

Some people suggest that if the price of something is raised, buyers will take more or the same amount. That’s silly because there’d be no limit to the price that sellers would charge. For example, if a grocer knew he would sell more — or the same amount of — milk at $8 a gallon than at $4 a gallon, why in the world would he sell it at $4? Then the question becomes: Why would he sell it at $8 if people would buy the same amount at a higher price?

There are economists, most notably Nobel Prize-winning economist Paul Krugman, who suggest that the law of demand applies to everything except labor prices (wages) of low-skilled workers. Krugman says that paying fast-food workers $15 an hour wouldn’t cause big companies such as McDonald’s to cut jobs. In other words, Krugman argues that raising the minimum wage doesn’t change employer behavior.

Before we address Krugman’s fallacious argument, think about this: One of Galileo’s laws says the influence of gravity on a falling body in a vacuum is to cause it to accelerate at a rate of 32 feet per second per second. That applies to a falling rock, steel ball or feather. What would you think of the reasoning capacity of a Nobel Prize-winning physicist who’d argue that because human beings are not rocks, steel balls or feathers, Galileo’s law of falling bodies doesn’t apply to them?

Krugman says that most minimum-wage workers are employed in what he calls non-tradable industries — industries that can’t move to China. He says that there are few mechanization opportunities where minimum-wage workers are employed — for example, fast-food restaurants, hotels, etc. That being the case, he contends, seeing as there aren’t good substitutes for minimum-wage workers, they won’t suffer unemployment from increases in the minimum wage. In other words, the law of demand doesn’t apply to them.

Let’s look at some of the history of some of Krugman’s non-tradable industries. During the 1940s and ’50s, there were very few self-serve gasoline stations. There were also theater ushers to show patrons to their seats. In 1900, 41 percent of the U.S. labor force was employed in agriculture. Now most gas stations are self-serve. Theater ushers disappeared. And only 2 percent of today’s labor force works in agricultural jobs. There are many other examples of buyers of labor services seeking and ultimately finding substitutes when labor prices rise. It’s economic malpractice for economists to suggest that they don’t.

Walter E. Williams is a professor of economics at George Mason University. To find out more about Walter E. Williams and read features by other Creators Syndicate writers and cartoonists, visit the Creators Syndicate Web page at www.creators.com.

I guessed Krugman in about a half second. He’s gone full retard.

Next he’s going to tell us Moochelle is the most gorgeous first lady in history.

Submitted by Tyler Durden on 10/13/2014 14:12 -0400

None other than Paul Krugman – the Nobel Prize-winning economist – once one of the president’s most notable critics, explains why Obama is a historic success…

Excerpted from Rolling Stone (read full Op-Ed here),

Obama faces trash talk left, right and center – literally – and doesn’t deserve it.

Despite bitter opposition, despite having come close to self-inflicted disaster, Obama has emerged as one of the most consequential and, yes, successful presidents in American history. His health reform is imperfect but still a huge step forward – and it’s working better than anyone expected. Financial reform fell far short of what should have happened, but it’s much more effective than you’d think. Economic management has been half-crippled by Republican obstruction, but has nonetheless been much better than in other advanced countries. And environmental policy is starting to look like it could be a major legacy.

…

Yes, Obama has a low approval rating compared with earlier presidents. But there are a number of reasons to believe that presidential approval doesn’t mean the same thing that it used to.

…

A constant of his time in office is the onslaught from the right, which has never stopped portraying him as an Islamic atheist Marxist Kenyan. Nothing has changed on that front, and nothing will.

Finally, there’s the constant belittling of Obama from mainstream pundits and talking heads.

…

Am I damning with faint praise? Not at all. This is what a successful presidency looks like. No president gets to do everything his supporters expected him to. FDR left behind a reformed nation, but one in which the wealthy retained a lot of power and privilege. On the other side, for all his anti-government rhetoric, Reagan left the core institutions of the New Deal and the Great Society in place. I don’t care about the fact that Obama hasn’t lived up to the golden dreams of 2008, and I care even less about his approval rating. I do care that he has, when all is said and done, achieved a lot. That is, as Joe Biden didn’t quite say, a big deal.

* * *

No comment…

Guest Post by Jesse

Apparently today is my day to pick on poor Paul Krugman. I happened to read this today, and it was just too illustrative of a certain institutional economic mindset to go by unremarked.

Paul is responding to questions for an interview in the latest issue of Princeton Magazine.

Are bubbles good or bad and do we need them to create strong economic growth and reach higher levels of employment?

Bubbles are bad if you have an economy near full employment, where they divert resources from their proper use and set the stage for financial instability. In a depressed economy, even ill-conceived spending can help create jobs, so bubbles aren’t necessarily bad. There are reasons to believe that we’re facing an era of persistent economic weakness, which means that we’ll only feel prosperous during bubble periods.

Please comment on how artificially low interest rates have impacted the current value of baby boomers’ retirement portfolios and should this be a consideration of the Federal Reserve?

Oh, boy. What do you mean ‘artificially low’? Compared to what? The appropriate level of the interest rate, most economists would say, is the rate that gives us full employment without inflation; since we don’t have full employment, that says that rates are too high.

And no, the Fed’s job is to stabilize the economy, not to protect incomes of some groups at the expense of that mandate.

Paul Krugman, Princeton Magazine

It’s one thing to infer that the economists of the professional status quo believe these sorts of things. And its quite another to see it in print.

Paul apparently thinks that bubbles are not really a problem if you are not at ‘full employment,’ because they might be stimulus. Oh boy, what do you mean ‘full employment?’ Does that mean everyone who wants a shit job without benefits at a below poverty level wage can have one is ‘full employment?’

Or does ‘full employment’ mean a robust economic environment where people are obtaining jobs that pay living wages for families that keep up with inflation and provide affordable health benefits sufficient to keep them from falling into bankruptcy if anyone in their family sustains a serious illness?

Well, we haven’t been at ‘full employment’ since the last bubble broke, and that was six years ago. And depending on how you want to define it, we may not have been at ‘full employment’ in a very long time of stagnant median wages and a deteriorating middle class.

So I would imagine that means that Paul was ok with the housing bubble, at least while it was growing. In his defense the Fed publicly dismissed it as well. And reading this interview helps one to understand why.

But that doesn’t bother me so much, since this is the policy jargon used by economists to justify whatever policy initiative they are pumping for that day, for whatever reason. And most do it.

What does surprise is that it doesn’t seem to matter to a Nobel prize-winning economist is ok with a bubble, which by definition in the real world is a significant mispricing of risk, will almost always result in stress on the financial system, and inflicts harmful losses on less sophisticated and non-insiders.

Bubbles by their very nature are very often symptoms of lax regulation, and methods of transferring wealth from the many to the few. And they are very often a fairly thin veneer for control frauds.

Paul goes on to suggest that we are in a new normal where the bubbles that the Fed occasionally creates through its policy errors are the only times that ‘we will feel prosperous.’ So enjoy. This is preposterous humbug. It is the worst sort of excuse making for the failure of leadership.

Does he notice that this latest ‘recovery’ from the aftermath of the latest financial bubble is resulting in the greatest disparity of wealth in US since before the Great Depression? And that it is growing worse, not better?

His statement that the Fed’s overwhelming mandate to provide ‘stability,’ for which you can read the health of the banks, is superior in consideration to protecting the income (wealth) of some groups like retirees, should give you a good idea of the Fed’s actions in the future when this current asset bubble implodes, and the Banks come back to their trough again. Bail-in anyone?

Does this criticism seem harsh? I hate to pick on the establishment Democrats, since their counterparts the neo-liberal austerians are often so much worse.

But given that too large a part of the country has been enduring the equivalent of an economic ‘Death March of Bataan’ for the last seven years because the Wall Street wing of the Democratic party, which was given a mandate for reform, has perpetrated so many poorly thought out and corporate friendly economic policies, written by non-elected and barely accountable Banksters operating largely in secret, I don’t think so. And they can’t keep blaming it all on the Republicans. They are both failing, and badly.

This should give you a fairly good idea where the financiers and politicians are coming from these days. Even the so-called ‘liberals.’

Protect yourself.

Somebody give this guy another Nobel. His brilliance is breathtaking to behold.

From David Stockman

Presented without comment because Krugman speaks best for himself!

Here is Paul Krugman, writing in 2006:

American health care is desperately in need of reform. But what form should change take? Are there any useful examples we can turn to for guidance?

Well, I know about a health care system that has been highly successful in containing costs, yet provides excellent care. And the story of this system’s success provides a helpful corrective to anti-government ideology. For the government doesn’t just pay the bills in this system — it runs the hospitals and clinics.

No, I’m not talking about some faraway country. The system in question is our very own Veterans Health Administration, whose success story is one of the best-kept secrets in the American policy debate.

Here is Krugman again, in 2011:

What Mr. Romney and everyone else should know is that the [Veterans Health Administration] is a huge policy success story, which offers important lessons for future health reform. And yes, this is “socialized medicine” — although some private systems, like Kaiser Permanente, share many of the V.H.A.’s virtues. But it works — and suggests what it will take to solve the troubles of U.S. health care more broadly.

This argument has been fairly popular in liberal circles for years. Phillip Longman has written extensively about how great the VA healthcare system is and why it should serve as a model for broader healthcare reform.

David Stockman tears Krugman a new asshole to go along with the one on his face.

If you are not Professor Paul Krugman you probably agree that Washington has left no stone unturned on the Keynesian stimulus front since the crisis of September 2008. The Fed’s balance sheet started that month at $900 billion–a figure it had accumulated mostly in dribs and drabs over the course of its first 94 years. Bubbles Ben then generated the next $900 billion in 7 weeks of mad money printing designed to keep the tottering gambling halls of Wall Street afloat. And by the time the “taper” is over later this year (?) the Fed’s balance sheet will exceed $4.7 trillion.

So $4 trillion in new central bank liabilities in six years. All conjured out of thin air. All monetary vaporware issued in exchange for treasury and GSE paper that had originally financed the consumption of real labor, material and capital resources.

And if $4 trillion of monetary magic was not enough, the action on the fiscal front was no less fulsome. At the time in March 2008 that Goldman’s plenipotentiary in Washington, Secretary Hank Paulson, joined hands with the People’s Tribune from Pacific Heights, Speaker Nancy Pelosi, to revive Jimmy Carter’s infamous $50 per family tax rebate, hoping America’s flagging consumers would be induced to buy a flat-screen TV, dinner at Red Lobster or new pair of shoes, the public debt was $9 trillion. It will be $18 trillion by the time the current “un-ceiling” on the Federal debt completes its election year leave of absence next March.

Yet $9 trillion of added national debt in six years is not the half of it. Even our Washington betters do not claim to have outlawed the business cycle, and we are now in month 57 of this expansion. Given that the average expansion during the ten “recovery” cycles since 1950 has been 53 months, it might be argued that we are already on borrowed time fiscally. That is, we have already used up the forward area on Uncle Sam’s balance sheet that is supposed to be available to absorb the predictable eruption of red ink that will occur during the next recession or financial bubble collapse or China melt-down etc.

In fact, peering at the future through its Keynesian goggles, the CBO assumes that the US economy will accelerate to nearly 3.5 percent average GDP growth until it reaches “full employment” around 2017, and then will remain in that beneficent state for all remaining time, world without end! Yet even then it projects a cumulative deficit of nearly $10 trillion under “current policy” (i.e. bipartisan can-kicking of expiring tax and spending giveaways) over the next decade.

Given the self-evident economic headwinds both at home and abroad, however, it would not be unreasonable to set aside CBO’s Rosy Scenario 2.0—a delusion I have some personal familiarity with, having invented the original version 33-years ago to the day. Indeed, a more prudent 10-year macroeconomic scenario might be simply “copy and paste”. That is to say, take the average growth rate of GDP, jobs, income and investment over the past decade and assume that the inevitable macroeconomic bumps and grinds of the next decade will average out about the same.

To be sure, some pessimists might note that more than 27 million working age citizens have dropped off the employment rolls since 2000; that presently 10,000 more are retiring each and every day; and that the ingredients of future growth have been radically short-changed, given that real investment in business fixed assets has averaged less than 1% annually for the past 14 years. So “copy and paste” might be hard to achieve in the real world ahead, but even then the added cumulative Federal deficit would total $15 trillion over the next decade under current policy.

In other words, until the sleepwalking denizens of the Washington beltway “do something” about a fiscal doomsday machine that has been put on auto-pilot since the 2008 crisis, the nation is likely to end up with upwards of $35 trillion of national debt by the middle of the next decade, while a “copy and paste” growth rate of nominal GDP (2000-2013= 4.0%) would end up at $25 trillion. In short, what is built into our fiscal future right now is a Big Fat Greek debt ratio of 140%.

Now comes Professor Krugman proposing to “do something”:

…. we should aggressively reverse the fiscal austerity of the last few years, getting government at all levels spending several points of GDP more to boost demand…. let’s say for the sake of argument that the right policy is two years of fiscal expansion amounting to 3 percent of GDP each year, plus a permanent rise in the inflation target to 4 percent. These wouldn’t be radical moves in terms of Econ 101 — they are in fact pretty much what textbook models would suggest make sense given what we have learned about macroeconomic vulnerabilities…

In short, Krugman wants to double-down on the lunacy we have already accomplished. His 4% inflation target is just code for re-accelerating the Fed’s money printing machine, thereby keeping real interest in deeply negative terrain for even more years beyond the seven-year ZIRP target the Fed has already promised. And while the Wall Street gamblers who prosper mightily from the free money carry trades enabled by this insult to honest financial markets might not even appreciate the favor, its possible that millions of Main Street households not “indexed” to Krugman’s beneficent 4% inflation target might well notice its impact.

The math is not promising. Under Krugman’s inflation RX, today’s median household income of $51,000 would compute out to $33,000 in constant dollars a decade hence—taking it back to pre-Korean War levels. But do not be troubled, of course, because right there in Krugman’s Dynamic Stochastic General Equilibrium Model (i.e. DSGE) it shows that every Wal-Mart shift supervisor will get at least a 4% wage increase each year, and that all retirees with a decent bundle of lifetime cash savings will earn at least a 4% annual return by investing in Dan Loeb’s hedge fund.

If you do not understand the DSGE, however, you might say good luck with that. And you might say that wantonly adding another $1 trillion to the national debt over the next two years, as Krugman has also prescribed, amounts to carrying “bathtub economics” to a downright absurd extreme.

At the end of the day, Professor Krugman and his Keynesian acolytes believe in a mysterious economic ether called “aggregate demand”. And through the wonders of their DSGE models they can measure the precise shortfall between aggregate demand under the nirvana of ”full employment” and the actual level of aggregate demand ( i.e GDP or spending”) generated by 150 million workers and 300 million consumers struggling to make ends meet in today’s real world. The whole point of fiscal and monetary ”stimulus”, therefore, is to insure that America’s economic bathtub is filled right up to the brim with aggregate demand, thereby insuring maximum growth of jobs, GDP and societal bliss.

Except that “aggregate demand” is a Keynesian fairy-tale that has now been playing for more than a half-century. In fact, spending or GDP cannot be conjured by the fiscal and monetary tricks of the state. Spending can only come from current income, which is the reward for current production; or it can come from borrowing, which is a claim on future income that will reduce borrowing capacity tomorrow in order to have more spending today.

In fact, four decades of fiscal and monetary stimulus have essentially layered spending from a one-time credit expansion on top of spending from current income. Unfortunately, we are presently nigh onto “peak debt”; that is, the balance sheets of households, business and the public sector have been used up after the great debt party (i.e. national LBO) since 1980 has taken the US economy’s historic leverage ratio (total credit market debt to GDP) from 1.5 turns to 3.5 turns.

That’s evident even in the specious GDP numbers from Washington’s statistical mills. If you set the aside short-run stocking and destocking of inventories in the quarterly GDP figures, the year-over-year gain in final real sales for Q4 2013 was 1.9%; and that’s also close enough for government work to the 2.5% gain ending in Q4 2012; the 1.8% rate in Q4 2011; and the 2.0% gain in Q4 2010.

In short, there is no “escape velocity” because the Fed’s credit channel is broken and done. Going forward, the American people will once again be required to live within their means, spending no more than they produce.

By contrast, Professor Krugman’s destructive recipes are entirely the product of a countrafactual economic universe that does not actually exist. He wants us to borrow and print even more because our macro-economic bathtub is not yet full. And that part is true. It doesn’t even exist.

“Economics is haunted by more fallacies than any other study known to man. This is no accident. While certain public policies would in the long run benefit everybody, other policies would benefit one group only at the expense of all other groups. The group that would benefit by such policies, having such a direct interest in them, will argue for them plausibly and persistently. It will hire the best buyable minds to devote their whole time to presenting its case. And it will finally either convince the general public that its case is sound, or so befuddle it that clear thinking on the subject becomes next to impossible.

In addition to these endless pleadings of self-interest, there is a second main factor that spawns new economic fallacies every day. This is the persistent tendency of man to see only the immediate effects of a given policy, or its effects only on a special group, and to neglect to inquire what the long-run effects of that policy will be not only on that special group but on all groups. It is the fallacy of overlooking secondary consequences.” – Henry Hazlitt – Economics in One Lesson

Saturday was the first day since a double shot of snow and ice storms hit the Philadelphia metro area on Monday and Wednesday I had a chance to drive around Montgomery County and witness the devastation firsthand. Over 750,000 homes lost power at the height of the ice storm on Wednesday and over 100,000 remained without power this past weekend. The mainstream media has become such a farce and propaganda machine for vested interests, it is essential to verify with your own eyes everything they report as fact. Their purpose is to entertain the consciously ignorant, exaggerate threats to keep the low IQ multitudes fearful, and function as mouthpieces for the ruling class. Deceitful corporate executives, mendacious government apparatchiks, and oblivious teleprompter reading media talking heads have been utilizing cold weather as an excuse for every poor earnings announcement, horrific employment report, and dreadful decline in retail sales. It certainly has nothing to do with decades of stagnant household income, awful monetary and fiscal policies, or the consequences of Obamacare.

We have become a delusional state dependent upon fallacies to convince ourselves our foolhardy beliefs, ludicrous economic policies, corrupt captured political system, and preposterously fraudulent financial system are actually based on sound logic and reason. Some fallacies have been perpetrated intentionally by the ruling class to manipulate, sway and deceive the populace, while others have been willfully employed by millions of techno-narcissistic iGadget addicted zombies as a substitute for thinking, reasoning and taking responsibility for the course of our nation.

You have men who constitute the unseen true ruling power of the country making a conscious and intentional effort to peddle fallacies to the masses in order to manipulate, mold, and corral them in a manner beneficial to the ruling power, financially, politically, and socially. The ruling class has been hugely successful in their capture of the public mind, creating a vast majority of the willfully ignorant who desperately grasp at fallacious concepts, beliefs, and storylines in order to avoid dealing with reality and being accountable for their actions and the actions of their leaders.

The fallacy being flogged by government drones and the legacy media about companies not hiring new employees because it has been cold and snowy during the winter is beyond absurd, except to someone who lives in the cocoon of Washington D.C. or regurgitates words processed on a teleprompter by paid minions of the ruling class. If you live in the real world, run a business, or manage employees, you understand weather has absolutely nothing to do with your decision to hire an employee. An organization takes weeks or months to hire employees. They don’t stop hiring because it snowed on Wednesday or the temperature was below normal. The contention that hiring has been weak for the last two months due to weather is outlandish and based upon flawed logic and warped reasoning. It is so illogical, only an Ivy League economist could believe it.

The other fallacy being pontificated by retail executives in denial, cheerleaders on CNBC and the rest of the propaganda press is weather is to blame for terrible retail sales over the last quarter. Again, this argument is specious in its conception. The retail executives use weather as an excuse for their failure in execution, hubris in over-expanding, and arrogance in pursuit of quarterly earnings per share and bonuses. CNBC and the rest of the Wall Street media pawns must provide lame fallacies for the corporate fascists regarding our downward economic path or the masses my wake up to reality. Protecting and expanding the wealth of the parasitic oligarch class is the one and only purpose of the corporate media.

Think about whether cold and snow in the winter will really stop purchases by individuals. If you need a new shirt for work or a pair of sneakers and it snows on Wednesday, you will wait until Saturday to make the purchase. Groceries will be consumed and replenished whether it is cold and snowy, or not. If an appliance or car breaks down, weather will be a non-factor in the new purchase decision. The proliferation of on-line retailing allows everyone to shop from the warmth of their homes. If anything, bad winter weather often spurs stocking up of groceries and the purchase of items needed to contend with winter weather (salt, shovels, coats, hats, gloves). Only an asinine spokes-model bimbo on CNBC could non-questioningly report the press release excuses of retailers. Critical thinking skills and journalistic integrity are non-essential traits among the propaganda mainstream press today.

Revealing the truth about pitiful employment growth and dreadful retail sales would destroy the fallacy of economic recovery stimulated by the monetary policies of the Federal Reserve and fiscal policies of the Federal government. The ruling class must perpetuate the myth that central bankers pumping $3.2 trillion of debt into the veins Wall Street banks and Obama dumping $6.7 trillion of debt onto the shoulders of future generations in order to cure a cancerous disease created by debt, has revived our economy and cured the disease. The unseen governing class cannot admit their traitorous actions have impoverished the working middle class, destroyed small businesses, depleted senior citizens of their savings, and warped our economic system to such an extent that recovery in now impossible. If the ignorant masses were to become sentient, the ruling class would become lamppost decorations.

After discovering water pipes at my rental property had burst due to the extreme cold weather and witnessing the widespread damage caused by the mid-week ice storm, I immediately thought how overjoyed my favorite Keynesian, Ivy League, Nobel Prize winning, New York Times scribbler, Paul (destruction is good) Krugman must be. All this destruction and devastation will be a tremendous boost to the economy according to Krugman and his ilk. This intellectually deceitful, morally bankrupt, despicable excuse for a human being spoke these words of wisdom three days after the 9/11 attacks:

“Ghastly as it may seem to say this, the terror attack – like the original day of infamy, which brought an end to the Great Depression – could even do some economic good. So the direct economic impact of the attacks will probably not be that bad. And there will, potentially, be two favorable effects. First, the driving force behind the economic slowdown has been a plunge in business investment. Now, all of a sudden, we need some new office buildings. As I’ve already indicated, the destruction isn’t big compared with the economy, but rebuilding will generate at least some increase in business spending.”

He had expanded his broken window beliefs to broken buildings, broken nations, and a broken people. You can’t keep a cunning Keynesian down when they need to propagate discredited fallacies in order to feed their own ego and promote foolish debt fueled spending by government, consumers and corporations as a solution to all economic ills. It makes no difference to a statist like Krugman that Frederic Bastiat had obliterated the preposterous notion that destruction and the money spent to repair the destruction was a net benefit to society, 164 years ago in his essay – That Which is Seen, and That Which is Not Seen. Bastiat’s logic is unassailable. Only the most highly educated Princeton economists don’t get it.

Have you ever witnessed the anger of the good shopkeeper, James B., when his careless son has happened to break a pane of glass? If you have been present at such a scene, you will most assuredly bear witness to the fact that every one of the spectators, were there even thirty of them, by common consent apparently, offered the unfortunate owner this invariable consolation – “It is an ill wind that blows nobody good. Everybody must live, and what would become of the glaziers if panes of glass were never broken?”

Now, this form of condolence contains an entire theory, which it will be well to show up in this simple case, seeing that it is precisely the same as that which, unhappily, regulates the greater part of our economical institutions.

Suppose it cost six francs to repair the damage, and you say that the accident brings six francs to the glazier’s trade – that it encourages that trade to the amount of six francs – I grant it; I have not a word to say against it; you reason justly. The glazier comes, performs his task, receives his six francs, rubs his hands, and, in his heart, blesses the careless child. All this is that which is seen.

But if, on the other hand, you come to the conclusion, as is too often the case, that it is a good thing to break windows, that it causes money to circulate, and that the encouragement of industry in general will be the result of it, you will oblige me to call out, “Stop there! Your theory is confined to that which is seen; it takes no account of that which is not seen.”

It is not seen that as our shopkeeper has spent six francs upon one thing, he cannot spend them upon another. It is not seen that if he had not had a window to replace, he would, perhaps, have replaced his old shoes, or added another book to his library. In short, he would have employed his six francs in some way, which this accident has prevented.

I wonder whether the myopic focus on only immediate impacts and inability of ideologues to understand unintended consequences is premeditated or just erroneous reasoning. The broken window fallacy can now be extended to broken limbs and burst pipes across the Northeast. Huge trees have been toppled, limbs and branches are strewn on the properties of homeowners across the region, homes and businesses have been physically damaged, and power outages wrecked profits at small businesses. Society has gained no benefit whatsoever from the mass destruction wrought by these storms. Thi

s weather induced ruin exposes GDP calculations as useless and misleading regarding the true economic health of the nation. The hundreds of millions in destruction will not be factored into the GDP calculation, but the spending by homeowners and businesses to remove downed trees, fix broken roofs, replace burst pipes and clean-up debris will be factored positively in the GDP calculation. The inevitable politician response will be increased government spending to repair damage to infrastructure. This will also be additive to GDP. Krugman will get a tingle up his leg.

CNBC’s Cramer & Liesman will rave about the unexpectedly strong GDP in the first quarter as proof the economy is doing great. The fallacy that GDP growth and stock market gains are beneficial to the average American will be flogged by the propaganda press at the behest of the ruling class until the last vestiges of national wealth are confiscated by the oligarchs. In the real world, the destruction caused by the harsh winter weather will not benefit society one iota. GDP will reflect the immediate short-term seen impact of the cleanup and repair of property damage. GDP will ignore the unseen opportunity costs which were lost and the long-term consequences of expenditures made to put property back in the condition in which it started. Destruction does not create profit, except in the Keynesian world of Krugman and his Ivy League educated sycophant cronies.

There are 2.5 million households in the Philadelphia metro area. There are hundreds of thousands with trees down, pipes frozen, gutters smashed, roofs leaking and electrical infrastructure damaged. An individual homeowner with a couple of large trees down will need to pay $500 to $1,000 for a tree service to remove the debris from their property. Considering the median household income in Montgomery County, PA is $75,000, that is not an insubstantial sum.

The homeowner did not anticipate this expenditure and will react by not dining out, taking a shorter vacation, not buying that new couch, or not investing in their small business. A landlord who has to repair busted pipes will incur added expense, resulting in less profit. Less profit means less taxes paid to the state and federal government, exacerbating their budget deficits. The landlord will defer replacing that old air conditioner for at least another year. Multiply these scenarios across the entire Northeastern United States and you have the long-term negative financial implications outweighing the short-term boost to GDP.

The Keynesian fallacy of increased economic activity being beneficial is annihilated by the fact homeowners and business owners are left in the same condition as they were prior to the storms, while the money spent to achieve the same property condition was not spent on other goods and services that would have truly expanded the economy. The fallacious government engineered GDP calculation will portray destruction as an economic boost. Keynesian worshiping economists and government bureaucrats observe this tragedy as only between two parties, the consumer who is forced to repair their property and is denied the pleasure of spending their money on something more enjoyable and the tree service company who experiences a positive impact to their business. They exclude the appliance store, restaurant, or hotel that did not receive the money spent on repairing the property. It is this third unseen party who is left out of the equation. It is this third party that shows the absurdity of believing destruction leads to profit and economic advancement. The national economic output is not increased, but highly educated government drones and Wall Street captured economists will point to GDP and disseminate the fallacy.

This leads us to government in general and the fallacy that government spending, government borrowing, and government programs are beneficial to society and the economy. Legalized plunder of the populace through income taxes, real estate taxes, sales taxes, gasoline taxes, cigarette taxes, license fees, sewer fees, tolls, and a myriad of other ass raping techniques is used to subsidize crony capitalist special interests, the military industrial complex, faux wars on poverty, drugs and terror, a failed public education system, vote buying entitlement programs, and a tax code written to benefit those who pay the biggest bribes to the corrupt politicians slithering around the halls of congress.

Government is a criminal enterprise designed to take from the weak and powerless while benefitting the connected and powerful. The government extracts the earnings of citizens and businesses at the point of a gun and redistributes those funds to special interests; funding boondoggles, wars of choice, foreign dictators, and the corporate and banking interests who control the puppet strings of Washington politicians. State organized and legal plunder designed to enrich everyone at the expense of everyone else is the delusional fallacy permeating our cultural mindset today.

President Obama declared my region a disaster area, allowing for government funds to supposedly help in the cleanup efforts. Again, the fallacy of government intervention benefiting society is unquestioned by the ignorant masses. Local and State governments are required by law to balance their budgets. The never ending progression of storms and record cold temperatures has already blown the winter storm budgets of transportation departments across the region. Gaping potholes are swallowing vehicles and will need to be repaired.

Government spokespersons and politicians tell the public not to worry. The government will come to the rescue, even when the funds officially run out. They won’t react the way a family would react to a budget overage, by cutting spending in another area. We have had mild winters in the recent past when the winter road budgets were far under. Did the government set aside this surplus for winters like the one we are currently experiencing? Of course not – they spent it on some other boondoggle program or useless shovel ready bridge to nowhere. Government politicians and their lackeys do not look beyond their 2 year election cycle.

The government budget overages due to winter storms will show up in the GDP calculation as a positive impact. A snowplow pushing snow to the side of the road and a crew filing a pothole has put the roadway back into the condition it was prior to the bad weather. The roadway is exactly the same. The money spent could have been used to pay down debt, fund the government pension shortfalls which will overwhelm taxpayers in the foreseeable future, or be given back to citizens to spend as they choose. There has been no net benefit to society.

No government spending provides a net benefit to society. Every government program, law, regulation, subsidy, tax or fee gives rise to a series of effects. The immediate seen effect may be favorable in the eyes of myopic politicians and an ignorant populace, but most government intervention in our lives proves to be fatal and unsustainable in the long-term. Whatever short-term benefits might accrue is far outweighed by the long-term negative implications on future generations. All government expenditures are foisted upon the public either through increased taxation or state created surreptitious inflation.

We have a country built on a Himalayan mountain of fallacies. We are a short-term oriented people who only care about our present situation, giving no thought about long-term consequences of our policies, programs, laws or actions. Critical thinking skills, reasoning abilities, and a basic understanding of mathematical concepts appear to be beyond our grasp. We’d rather believe falsehoods than deal with the harsh lessons of reality. We choose to experience the severe penalties of burying our heads in the sand over using our God given ability to think and foresee the future consequences of our irrational choices. We suffer from the ultimately fatal disease of ignorance, as described by Bastiat.

This explains the fatally grievous condition of mankind. Ignorance surrounds its cradle: then its actions are determined by their first consequences, the only ones which, in its first stage, it can see. It is only in the long run that it learns to take account of the others. It has to learn this lesson from two very different masters – experience and foresight. Experience teaches effectually, but brutally. It makes us acquainted with all the effects of an action, by causing us to feel them; and we cannot fail to finish by knowing that fire burns, if we have burned ourselves. For this rough teacher, I should like, if possible, to substitute a more gentle one. I mean Foresight.

It’s a big country and one fallacy doesn’t fit all. Some fallacies are committed purposefully by evil men with evil intent. The Wall Street financial elite, big corporations, big media and their politician puppets fall into this category. Other fallacies are executed by people whose salary depends upon the fallacies being believed by the masses. Middle level bankers, managers, journalists, and bureaucrats fall into this category. And lastly you have the willfully ignorant masses who would rather believe fallacies than look up from their iGadgets, Facebook, and Twitter and think. The thing about fallacies is they eventually are buried under an avalanche of reality. If you listen closely you can hear the rumble of snow beginning to give way on the mountaintop. Fallacies are about to be crushed and swept away by the real world of consequences.

“Wall Street had been doing business with pieces of paper; and now someone asked for a dollar, and it was discovered that the dollar had been mislaid. It was an experience for which the captains of industry were not entirely prepared; they had forgotten the public. It was like some great convulsion of nature, which made mockery of all the powers of men, and left the beholder dazed and terrified. In Wall Street men stood as if in a valley, and saw far above them the starting of an avalanche; they stood fascinated with horror, and watched it gathering headway; saw the clouds of dust rising up, and heard the roar of it swelling, and realized it was only a matter of time before it swept them to their destruction…

But it is difficult to get a man to understand something when his salary depends upon him not understanding it.”

Upton Sinclair – The Moneychangers

Submitted by Robert Murphy via The Ludwig von Mises Institute of Canada,

Over at CafeHayek, Russ Roberts is mystified at a recent Paul Krugman blog post. Concerning the debate over whether the US federal government should extend unemployment benefits, Krugman wrote on January 12:

There’s a sort of standard view on this issue, based on more or less Keynesian models. According to this view, enhanced UI actually creates jobs when the economy is depressed. Why? Because the economy suffers from an inadequate overall level of demand, and unemployment benefits put money in the hands of people likely to spend it, increasing demand.

You could, I suppose, muster various arguments against this proposition, or at least the wisdom of increasing UI. You might, for example, be worried about budget deficits. I’d argue against such concerns, but it would at least be a more or less comprehensible conversation.

But if you follow right-wing talk — by which I mean not Rush Limbaugh but the Wall Street Journal and famous economists like Robert Barro — you see the notion that aid to the unemployed can create jobs dismissed as self-evidently absurd. You think that you can reduce unemployment by paying people not to work? Hahahaha!

Before continuing, let’s be clear at the rhetorical devices Krugman uses here. First, he sets it up as the “standard view” that extending unemployment benefits (in a depressed economy) will boost job growth, through Keynesian demand-side effects.

Then, Krugman racks his brains trying to figure out how somehow could possibly disagree with this “standard view.” He says “I suppose” you might worry about the larger budget deficit that this would cause. He doesn’t offer any other possible mechanism by which someone might oppose it.

Finally, Krugman says that that’s not the argument that opponents are using. Instead, they are relying on a supply-side argument, claiming that it would reduce the incentive to work if you paid people not to work. In the context, it is clear that Krugman thinks this is NOT a good objection to the “standard” Keynesian view.

Against this backdrop, then, Russ Roberts is simply astounded because we can turn to Paul Krugman’s own (recent) books to elucidate this very argument–the one that “right-wingers” such as Robert Barro are advancing, much to Krugman’s horror. For example, in the 2010 edition of Krugman’s Essentials of Economics he writes:

People respond to incentives. If unemployment becomes more attractive because of the unemployment benefit, some unemployed workers may no longer try to find a job, or may not try to find one as quickly as they would without the benefit. Ways to get around this problem are to provide unemployment benefits only for a limited time or to require recipients to prove they are actively looking for a new job.

And, in the 2009 edition of Krugman’s textbook Economics he writes: “Generous unemployment benefits can increase both structural and frictional unemployment. So government policies intended to help workers can have the undesirable side effect of raising the natural rate of unemployment.”

So we see here, that the type of supply-side argument that Barro et al. bring up is one that Krugman himself endorses. Indeed, this is literally the “standard view on the topic.”

To be sure, a Keynesian like Krugman could argue that in the middle of a big economic slump that such supply-side issues are of only minor importance, and get trumped by demand-side factors. But that’s not at all the argument Krugman is making in this latest blog post. Instead, he is making it sound like Barro et al. are grasping at straws, and not even relying on a coherent argument (such as fear of bigger deficits) when trying to oppose extension of unemployment benefits.

Krugman does this in other contexts, too. To take just one other example: He has coined the terms “confidence fairy” and “invisible bond vigilantes” to mock economists who believe that investors might worry about rising government debt levels, and consequently favor faster action on bringing down deficits even though market interest rates are quite low for US government debt. Yet back in 2003 Krugman wrote:

With war looming, it’s time to be prepared. So last week I switched to a fixed-rate mortgage. It means higher monthly payments, but I’m terrified about what will happen to interest rates once financial markets wake up to the implications of skyrocketing budget deficits.

My point in the present post isn’t to accuse Krugman of outright contradictions, or to say he’s forbidden from ever changing his mind.

Rather, my point is that Krugman frequently accuses his opponents of being stupid and/or evil, when they present a view that he himself advanced in other circumstances. His typical readers would have no idea that Krugman once worried about bond vigilantes, or that his books lay out the standard case for why generous government unemployment benefits might contribute to structural unemployment. No, Krugman has led such typical readers to believe that anyone espousing such views is either a complete idiot–immune to theory and evidence that we’ve had since the 1930s–or is a paid shill who hates poor people.

“The growth of the Internet will slow drastically, as the flaw in ‘Metcalfe’s law’–which states that the number of potential connections in a network is proportional to the square of the number of participants–becomes apparent: most people have nothing to say to each other! By 2005 or so, it will become clear that the Internet’s impact on the economy has been no greater than the fax machine’s.”

Paul Krugman, 10 June 1998

“What an intellectually dishonest, morally bankrupt, dumbass, pompous, douchebag.”

Admin, December 30, 2013

http://jessescrossroadscafe.blogspot.com/

“I write to you from a disgraced profession. Economic theory, as widely taught since the 1980s, failed miserably to understand the forces behind the financial crisis.

Concepts including “rational expectations,” “market discipline,” and the “efficient markets hypothesis” led economists to argue that speculation would stabilize prices, that sellers would act to protect their reputations, that caveat emptor could be relied on, and that widespread fraud therefore could not occur.”

James K. Galbraith

There are several somewhat surprising assertions in this piece below from Paul Krugman, which left me almost speechless. But not quite.

I might be unfair in taking it seriously, or more seriously than one should do with what could be just a politically motivated puff piece. The Western central banks seem to be ‘in a jam’ as it were, and now is the time for all their men to come to the aid of the financial status quo.

First, Krugman is touting the fiat petro-dollar as somehow humanitarian, as compared to apparently the worst mine he could find, in order to throw stones at the gold industry. Or presumably anything real that comes out of or off of the ground for that matter, including natural resources and agricultural products, because one can find abuse of labour in all of them.

This is so off handed hypocritical as to be mind-boggling.

I think we can stipulate that abuses of capital and power can and do exist in any human endeavor, and the proper but occasionally underutilized role of government is to mitigate them.

Considering the carnage that the financial industry and the Banks have wreaked on the real economies of the world, I hope the hypocrisy here is obvious to anyone with any sense of current events whatsoever. Certainly we have no excuse to blind ourselves to the all too recent and terrible role of crony capitalism in destroying lives around the world in the endless pursuit of power, and the supremacy of greed. And that power is based largely on the dollar.

This is the great failing in Modern Monetary Theory. It assumes that if we make the creation of money easy enough, it will make the people who hold that power naturally virtuous, because it takes less effort to be good and so they will choose to be good.

This is the Zimbabwe school of public policy, and the John Law Institute of Economic Thought. The ‘scholar-gentry’ somehow imagine themselves as nature’s virtuous wise men, operating for the objective good, but the serial bubbles and crises in the West over the past twenty years show how this assumption is part of the efficient market hypothesis: a romantic canard.

Then Paul Krugman takes on Bitcoin. He posits it as based on a great mine located in Iceland that creates bit coins because it is cold there and electricity is cheap. I thought he might be speaking sardonically, but I’m not so sure.

Engineering students I know and their college friends mine bitcoins and litecoins from their dorm rooms, which are not particularly cold, but where electricity is essentially free. However the amount of electricity used is so minimal that it really doesn’t matter. But this is besides the real point.

What threw me for a loop was his snarky punch line designed to put the whole idea of Bitcoin to bed.

“we’re burning up resources to create “virtual gold” that consists of nothing but strings of digits…”

If this is not the very description of the modern dollar, except for the burning up resources line, used by Ben Bernanke in his famous speech in which he says that deflation is not a problem for a Fed that ‘owns a printing press,’ I don’t know what is. I might say misallocating resources to the financial sector rather than burning up resources, but that may be a nicety.

Krugman derides Bitcoin as ‘virtual gold’ but in reality it is much closer to ‘virtual dollars’ because both are created out of essentially nothing but a few key strokes and cycles on a computing machine.

Bitcoin has a limiting factor built in to it. Gold has a limiting factor in its natural scarcity.

The primary difference is that the dollar is backed by the power of the state, and bitcoins are relatively stateless, which is their weakness. Gold’s power is that the state cannot create it, merely abuse it.

This whole ‘progress’ concept is just a canard, as is the localizing of the view of gold to a few eccentric gold bugs.

If China and a few other central banks were not buying gold, and in size, there would be no issue here, and the status quo based on the Western dollar would not feel so threatened. Are China and these others merely ignorant gold bugs? Or are they reacting to a situation in a way that people have done throughout history?

They are seeking a refuge from the abuse of power by a status quo.

There is a classic policy disagreement about the international monetary system underway, which some have taken to calling a currency war, and most establishment economists are ignoring it, or talking it down. And this is why the next financial crisis is going to hit them smack in the face, like the last two crises which they aided and abetted, if nothing by their silent acquiescence.

Fiat money has been tried many, many times in the past, especially over the last few centuries. It has ended in the same manner every time.

As Bernard Baruch himself observed, ‘gold has worked since the times of Alexander.’ Baruch understood money and markets. But he was no servile economist, caught in a credibility trap.

Rather than dealing with reality, and understanding why people throughout history seems to be ‘voting’ in certain ways when there is a choice, and why China and other Asian and Mideastern nations and their central banks are buying gold in sizable quantities, Mr. Krugman just writes this off as some eccentricity, because it does not fit his model of how things should be.

And this is the stance of a statist, and it requires increasing use of force as people reject its falsity. It appears to be mere sophistry in the service of power, and it is unworthy. But this is economics today, cheerleaders for their favorite brand of political power. It is after all a social science more often used to rationalize rather then explain, except in its most basic elements and in its practical microeconomic applications.

Arguing for stimulus without acknowledging and addressing the flaws and obvious policy mistakes in the system that have led to multiple and increasingly destructive asset bubbles is beyond reckless, and almost wanton. But it is politically advantageous.

If Mr. Krugman were to honestly study what money is, rather than what he wishes it to be, things might be clearer and his thinking might be richer. Alan Greenspan has done this, but then he subordinated his knowledge to his careerist aspirations.

And perhaps this is what exercised me to write this more than anything else. As an academic economist and ‘very serious person,’ Krugman is arguing like a Fox news anchor, assaulting knowledge to score his political points. He is cloaking his policy advocacy in the trappings of his profession, and he thereby cheapens it. And this is why it has become disgraced.

Let me be clear on this. I am not proposing that gold become a new monetary standard. I think that a new international monetary regime will evolve, and that gold will play some part.

But I am saying that the public policy proposals put forward by economists are too often stuff and nonsense, merely rationales used to promote whatever ideology or power group they believe in, or seek to curry favour with, in the first place. And that the power to create money and distribute it is a deadly power, and has led to failures repeatedly over and over again. So safeguards must be taken with it.

And if gold is such a dead issue, then why does Krugman need to argue so bitterly against it, resorting to sophistry and ridicule and appeals to authority? It is because he is trying to force an argument against the will of a sizeable portion of the world’s people. It is a policy battle, with good points and bad points. But he chooses not to argue it honestly, exposing the good and the bad, but politically and cheaply.

These economic ‘laws’ are almost always arguments, but not proofs. But cloaked as proofs they help to overturn common sense all too often, and this has proven to be a tragedy as is so common with all quack scientific theories.

As I noted a few weeks ago:

“Economics is a profession that succumbed almost en masse, whether by individual actions or the complicit silence of careerism, to the pervasive corruption of financial fraud, and of the persuasive power of Wall Street, the Banks, and big money. The only group that approaches their failure is the national political and financial class, including the accountants and the regulators.

For the most part this has not yet changed because of the unreformed state of the financial system, combined with the snare of the credibility trap. And they cover their shame by calling themselves the ‘scholar-gentry’ and tut tutting about the failure of the public in much the same tones that the plutocrats of past colonial empires would agonize over the plight of the victims of their perfidy in terms of the white man’s burden.”

I strongly suspect that some of the Western central banks, led on by the bullion banks, have made some awful policy errors in the disposition of their nation’s resources over the past ten years. They have committed resources to what they considered a just cause without sufficient diligence, things do not rightly belong to them, thinking that they could retrieve them at some future date without too much effort.

And like any other client of the banks, they have been taken. With the inability to return the national gold to Germany as their people requested, they were staring into the abyss. So they seek to cover this up, and thereby keep digging themselves into an ever deeper hole. And this will prove to be worse than the original deed. It will destroy careers.

The would-be ruling class envisions a relatively unconstrained money supply as a tool amenable to the beneficent use of themselves as philosopher-kings. And it is a romantic falsehood like efficient market theory. Whose fiat?

Such a monetary authority gives the power to determine and distribute value and worth to a relatively small group of people who act on their own authority, and too often in secrecy. Well, we essentially have had that for some time, and as Dr. Phil might say, ‘And how’s that been working for you?

Like so many other romantic notions of the past, the implementation of romantic ideals in pursuit of a paradise would quite likely result in a hell on earth. The resort to force will become increasingly predatory, self-serving, and relentless.

Addendum: I have address Paul Krugman’s ‘quote’ from Adam Smith in more detail here.

NYT Times Op-Ed Columnist

Bits and Barbarism

By Paul Krugman

December 22, 2013

This is a tale of three money pits. It’s also a tale of monetary regress — of the strange determination of many people to turn the clock back on centuries of progress.

The first money pit is an actual pit — the Porgera open-pit gold mine in Papua New Guinea, one of the world’s top producers. The mine has a terrible reputation for both human rights abuses (rapes, beatings and killings by security personnel) and environmental damage (vast quantities of potentially toxic tailings dumped into a nearby river). But gold prices, while down from their recent peak, are still three times what they were a decade ago, so dig they must.

The second money pit is a lot stranger: the Bitcoin mine in Reykjanesbaer, Iceland. Bitcoin is a digital currency that has value because … well, it’s hard to say exactly why, but for the time being at least people are willing to buy it because they believe other people will be willing to buy it. It is, by design, a kind of virtual gold. And like gold, it can be mined: you can create new bitcoins, but only by solving very complex mathematical problems that require both a lot of computing power and a lot of electricity to run the computers.

Hence the location in Iceland, which has cheap electricity from hydropower and an abundance of cold air to cool those furiously churning machines. Even so, a lot of real resources are being used to create virtual objects with no clear use. (Paul K. does not understand how Bitcoin works.

The third money pit is hypothetical. Back in 1936 the economist John Maynard Keynes argued that increased government spending was needed to restore full employment. But then, as now, there was strong political resistance to any such proposal.

Clever stuff — but Keynes wasn’t finished. He went on to point out that the real-life activity of gold mining was a lot like his thought experiment. Gold miners were, after all, going to great lengths to dig cash out of the ground, even though unlimited amounts of cash could be created at essentially no cost with the printing press. And no sooner was gold dug up than much of it was buried again, in places like the gold vault of the Federal Reserve Bank of New York, where hundreds of thousands of gold bars sit, doing nothing in particular.

Keynes would, I think, have been sardonically amused to learn how little has changed in the past three generations. Public spending to fight unemployment is still anathema; miners are still spoiling the landscape to add to idle hoards of gold. (Keynes dubbed the gold standard a “barbarous relic.”) Bitcoin just adds to the joke. Gold, after all, has at least some real uses, e.g., to fill cavities; but now we’re burning up resources to create “virtual gold” that consists of nothing but strings of digits…

Read the entire op-ed here.

Posted by Jesse

The public relations propaganda campaign to convince the ignorant masses that Sandy’s impact on our economy will be minor and ultimately positive, as rebuilding boosts GDP, has begun. I’ve been hearing it on the corporate radio, seeing it on corporate TV and reading it in the corporate newspapers. There are stories in the press that this storm won’t hurt the earnings of insurers. The only way this can be true is if the insurance companies figure out a way to not pay claims. They wouldn’t do that. Would they?

It seems all the stories use unnamed economists as the background experts for their contention that this storm will not cause any big problems for the country. These are the same economists who never see a recession coming, never see a housing collapse, and are indoctrinated in Keynesian claptrap theory.

Bastiat understood the ridiculousness of Kenesianism and the foolishness of believing that a disaster leads to economic growth.

Bastiat’s original parable of the broken window from Ce qu’on voit et ce qu’on ne voit pas (1850):

Have you ever witnessed the anger of the good shopkeeper, James Goodfellow, when his careless son has happened to break a pane of glass? If you have been present at such a scene, you will most assuredly bear witness to the fact that every one of the spectators, were there even thirty of them, by common consent apparently, offered the unfortunate owner this invariable consolation—”It is an ill wind that blows nobody good. Everybody must live, and what would become of the glaziers if panes of glass were never broken?”

Now, this form of condolence contains an entire theory, which it will be well to show up in this simple case, seeing that it is precisely the same as that which, unhappily, regulates the greater part of our economical institutions.

Suppose it cost six francs to repair the damage, and you say that the accident brings six francs to the glazier’s trade—that it encourages that trade to the amount of six francs—I grant it; I have not a word to say against it; you reason justly. The glazier comes, performs his task, receives his six francs, rubs his hands, and, in his heart, blesses the careless child. All this is that which is seen.

But if, on the other hand, you come to the conclusion, as is too often the case, that it is a good thing to break windows, that it causes money to circulate, and that the encouragement of industry in general will be the result of it, you will oblige me to call out, “Stop there! Your theory is confined to that which is seen; it takes no account of that which is not seen.”