Authored by Sven Henrich via NorthmanTrader.com,

I’m of the long standing view that Fed chairs have one prime responsibility above all others: Keeping confidence up, and if it requires to sweet talk problems then that’s what it takes.

The often classic quote by Ben Bernanke of “subprime is contained” right before it blew up in everybody’s face being a prime example.

Is the Fed that blind to reality or just on an elaborate marketing mission to ensure that nobody panics and sells stocks? I leave that judgment to the reader.

But I can see differing messaging coming out the Fed when people are in office and when not.

Take corporate debt for example.

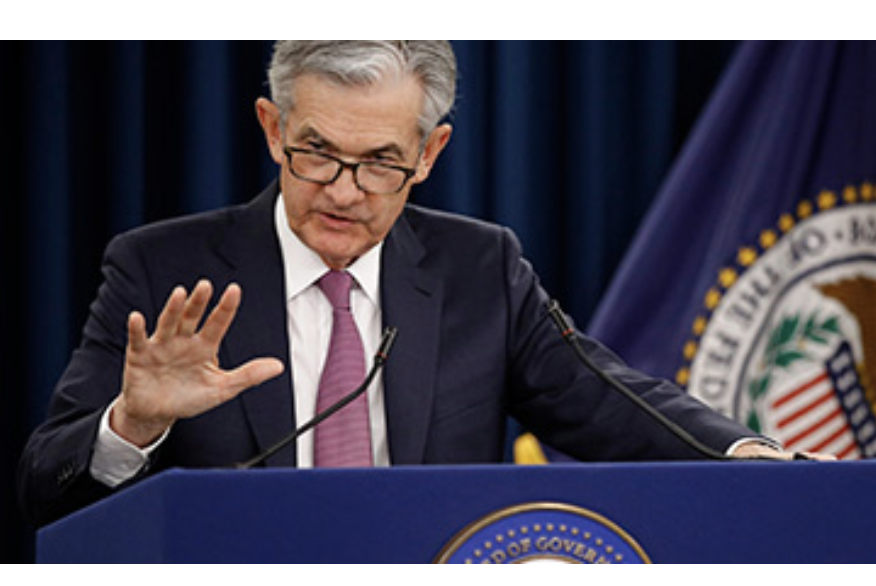

Continue reading “Ticking Time Bomb: Is This Powell’s “Subprime Is Contained” Moment?”