Donald J. Trump has taken credit for making America’s economy great again. He’s been crowing about all the jobs being created, the soaring consumer confidence and record highs in the stock market. It’s all because the Donald has inspired Americans about our glorious future.

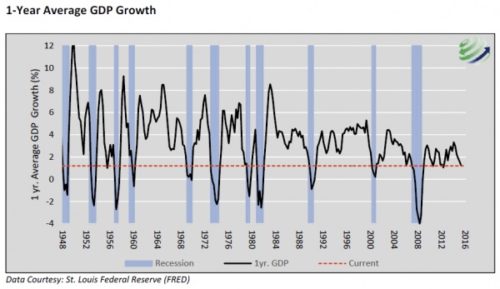

But, a funny thing has been happening in the real world. The economy has gone into the shitter and GDP will be lucky to reach 1% in the first quarter of his presidency. The bullshit consumer confidence surveys mean absolutely nothing. Feelings don’t mean shit. What consumers do is what matters.

67% of the US economy is dependent upon Americans spending money they don’t have on shit they don’t need. And they’ve dramatically reduced that spending. If consumers are so confident, why are a record number of major retailers going bankrupt and closing 3,500 stores in 2017? Mom and pop retailers have been shuttering for years.

If the narrative about a dramatically improving housing market was true, why would furniture store sales and building material store sales be falling? They wouldn’t. It seems even the spendthrift millennials have run out of dough, as restaurant sales are in free fall. Restaurant chains have begun closing units now. It has only just begun.

The auto industry ponzi scheme has come to an end, as billions in subprime loans to deadbeats is finally coming home to roost. If you lend money to idiots with no means to repay you, the loans will go bad. Auto sales have begun to fall and will continue to fall for the next couple years, as this house of cards built on the Fed’s easy money collapses.

How in the world does anyone with two brain cells believe the average American has the ability to keep increasing their spending when their wages are stagnant, real household income is falling, and Obamacare continues to siphon what little cash they might have. There is no Obamacare replacement on the horizon, which means no tax cuts. But there is the promise of new wars across the globe. We got that going for us.

Trump is a self proclaimed PR genius. As this economy spirals downward, followed by the stock market, I wonder if the Donald will step up and accept responsibility for the debacle when it happens. He needs to reap what he sows and accept responsibility if he is going to boast about his success in reviving the economy. Right Trumpeteers?

Continue reading “WILL TRUMP ACCEPT RESPONSIBILITY WHEN THIS SHITSHOW IMPLODES?”