In Part One of this article I documented the populist administration of Andrew Jackson and similarities to Donald Trump’s populist victory in the recent election. I’ll now try to assess the chances of a Trump presidency accomplishing its populist agenda.

The Trumpian Era

“But you must remember, my fellow-citizens, that eternal vigilance by the people is the price of liberty, and that you must pay the price if you wish to secure the blessing. It is to be regretted that the rich and powerful too often bend the acts of government to their own selfish purposes.” – Andrew Jackson

“For too long, a small group in our nation’s capital has reaped the rewards of government while the people have borne the cost. Washington flourished, but the people did not share in its wealth. Politicians prospered, but the jobs left and the factories closed. The establishment protected itself, but not the citizens of our country. Their victories have not been your victories. Their triumphs have not been your triumphs. And while they celebrated in our nation’s capital, there was little to celebrate for struggling families all across our land. What truly matters is not which party controls our government, but whether our government is controlled by the people. January 20th, 2017 will be remembered as the day the people became the rulers of this nation again. The forgotten men and women of our country will be forgotten no longer.” – Donald J. Trump – Inaugural Speech

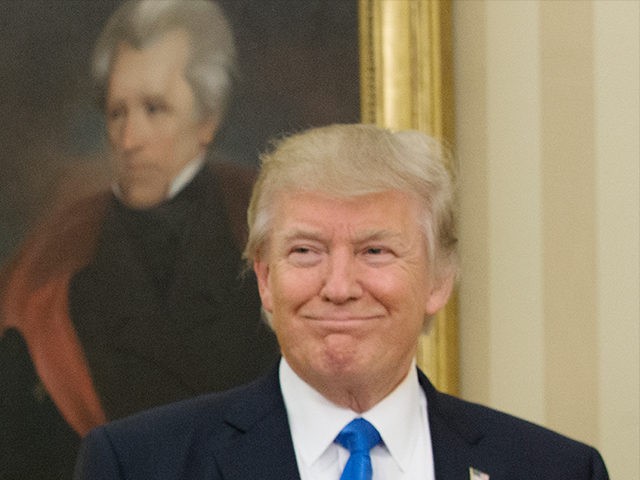

It is not a coincidence the painting in the oval office behind President Trump’s desk is of Andrew Jackson. He has promoted his presidency as a Jacksonian quest to return government to the people. His chief strategist Steve Bannon, a student of history, helped mold Trump’s speech with echoes of Jacksonian populism:

“It was an unvarnished declaration of the basic principles of his populist and kind of nationalist movement. It was given, I think, in a very powerful way. I don’t think we’ve had a speech like that since Andrew Jackson came to the White House. But you could see it was very Jacksonian. It’s got a deep, deep root of patriotism there.”

Continue reading “A NEW JACKSONIAN ERA? (PART TWO)”