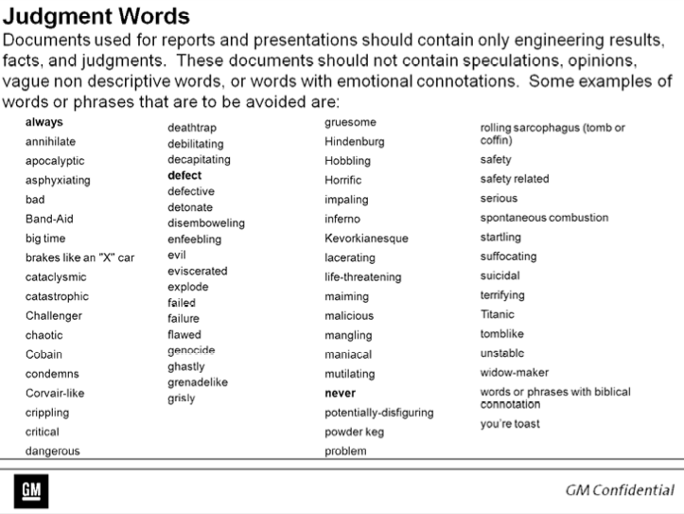

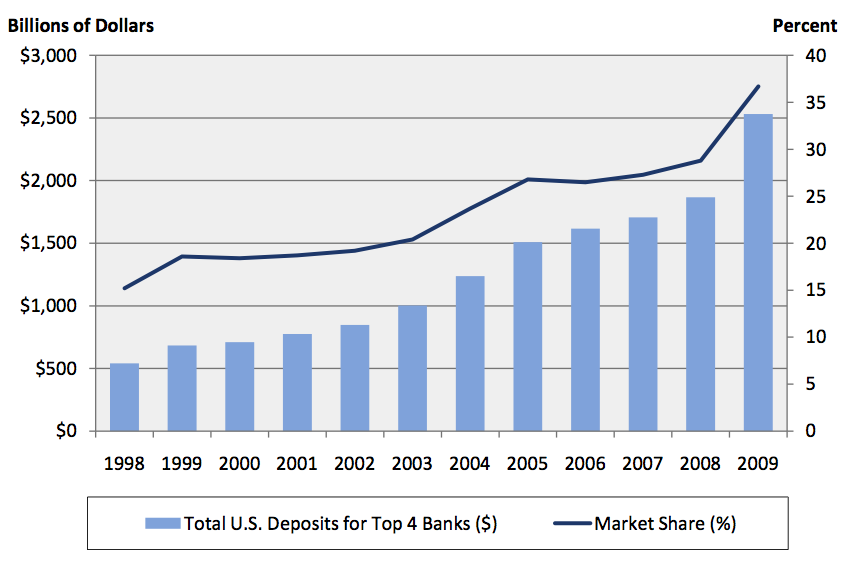

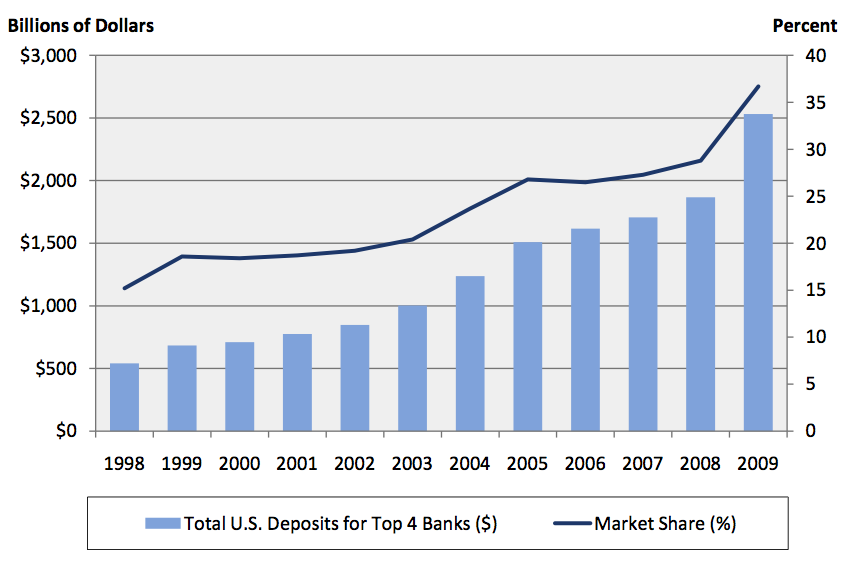

“We now have an economy in which five banks control over 50 percent of the entire banking industry, four or five corporations own most of the mainstream media, and the top one percent of families hold a greater share of the nation’s wealth than any time since 1930. This sort of concentration of wealth and power is a classic setup for the failure of a democratic republic and the stifling of organic economic growth.” – Jesse – http://jessescrossroadscafe.blogspot.com/

Source: Barry Ritholtz

“All of the old-timers knew that subprime mortgages were what we called neutron loans — they killed the people and left the houses.” – Louis S. Barnes, 58, a partner at Boulder West, a mortgage banking firm in Lafayette, Colo

The storyline that has been sold to the public by the Federal government, Wall Street, and the corporate mainstream media over the last two years is the economy is recovering and the banking system has recovered from its near death experience in 2008. Wall Street profits in 2009 & 2010 totaled approximately $80 billion. The stock market has risen almost 100% since the March 2009 lows. Wall Street CEOs were so impressed by this fantastic performance they dished out $43 billion in bonuses over the two year period to their thousands of Harvard MBA paper pushers. It is amazing that an industry that was effectively insolvent in October 2008 has made such a spectacular miraculous recovery. The truth is recovery is simple when you control the politicians and regulators, and own the organization that prints the money.

A systematic plan to create the illusion of stability and provide no-risk profits to the mega-Wall Street banks was implemented in early 2009 and continues today. The plan was developed by Ben Bernanke, Hank Paulson, Tim Geithner and the CEOs of the criminal Wall Street banking syndicate. The plan has been enabled by the FASB, SEC, IRS, FDIC and corrupt politicians in Washington D.C. This master plan has funneled hundreds of billions from taxpayers to the banks that created the greatest financial collapse in world history. The authorities had a choice. This country has bankruptcy laws. The criminally negligent Wall Street banks could have been liquidated in an orderly bankruptcy. Their good assets could have been sold off to banks that did not take their extreme greed based risks. Bond holders and stockholders would have been wiped out. Today, we would have a balanced banking system, with no Too Big To Fail institutions. Instead, the years of placing their cronies within governmental agencies and buying off politicians paid big dividends for Wall Street. Their return on investment has been fantastic.

The plan has been as follows:

- In April 2009 the FASB caved in to pressure from the Federal Reserve, Treasury, and Wall Street to suspend mark to market rules, allowing the Wall Street banks to value their loans and derivatives as if they were worth 100% of their book value.

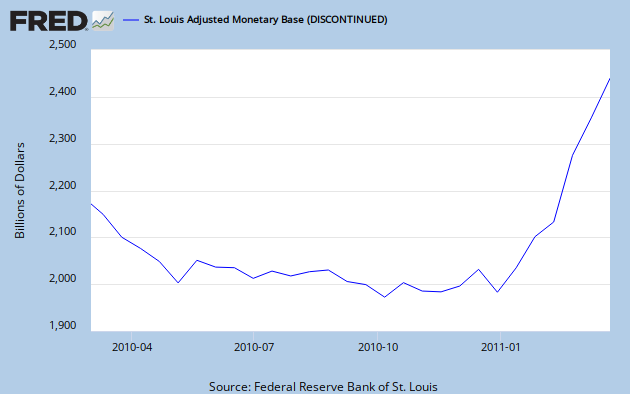

- The Federal Reserve balance sheet consistently totaled about $900 billion until September 2008. By December 2008, the balance sheet had swollen to $2.2 trillion as the Federal Reserve bought $1.3 trillion of toxic assets from the Wall Street banks, paying 100 cents on the dollar for assets worth 50% of that value.

- In November 2009 the Federal Reserve and IRS loosened the rules for restructuring commercial loans without triggering tax consequences. Banks were urged to extend loans on properties that had fallen 40% in value as if they were still worth 100% of the loan value.

- By December 2008 the Federal Reserve had moved their discount rate to 0%. For the last two years, the Wall Street banks have been able to borrow from the Federal Reserve for free and earn a risk free return of 2%. The Federal Reserve has essentially handed billions of dollars to Wall Street.

- When it became clear in October 2010 that after almost two years of unlimited liquidity being injected into the veins of zombie banks was failing, Ben Bernanke announced QE2. He has expanded the Fed balance sheet to $2.6 trillion by injecting $3.5 billion per day into the stock market by buying US Treasury bonds. Bernanke’s stated goal has been to pump up the stock market. While taking credit for driving stock prices higher, he denies any responsibility for the energy and food inflation that is spurring unrest around the world.

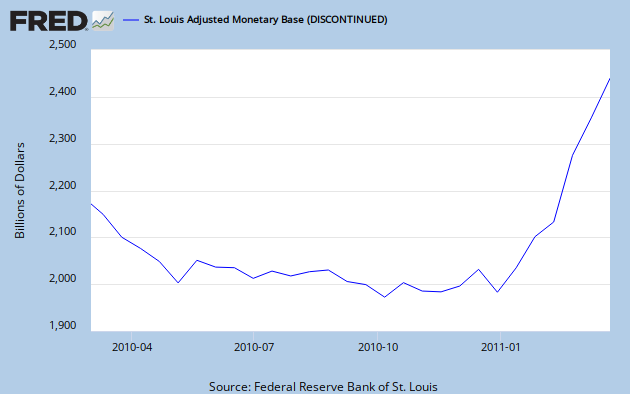

- The Federal Reserve has increased the monetary base by $500 billion in the last three months in a desperate attempt to give the appearance of recovery to a floundering economy.

- Beginning on December 31, 2010, through December 31, 2012, all noninterest-bearing transaction accounts are fully insured, regardless of the balance of the account, at all FDIC-insured institutions. The unlimited insurance coverage is available to all depositors, including consumers, businesses, and government entities. This unlimited insurance coverage is separate from, and in addition to, the insurance coverage provided to a depositor’s other deposit accounts held at an FDIC-insured institution.

When You’re Losing – Change the Rules

Wall Street banks had absolutely no problem with mark to market rules from 2000 through 2007, as the value of all their investments soared. These banks created products (subprime, no-doc, Alt-A mortgages) whose sole purpose was to encourage fraud. Their MBA geniuses created models that showed that if you packaged enough fraudulent loans together and paid Moody’s or S&P a big enough bribe, they magically became AAA products that could be sold to pension plans, municipalities, and insurance companies. These magnets of high finance were so consumed with greed they believed their own lies and loaded their balance sheets with the very toxic derivatives they were peddling to the clueless Europeans. They didn’t follow a basic rule. Don’t crap where you sleep. When the world came to its senses and realized that home prices weren’t really worth twice as much as they were in 2000, investment houses began to collapse like a house of cards. The AAA paper behind the plunging real estate wasn’t worth spit. After Lehman Brothers collapsed and AIG’s bets came up craps for the American people, the financial system rightly froze up.

After using fear and misinformation to ram through a $700 billion payoff to Goldman Sachs and their fellow Wall Street co-conspirators through Congress, it was time begin the game of extend and pretend. Market prices for the “assets” on the Wall Street banks’ books were only worth 30% of their original value. Obscuring the truth was now an absolute necessity for Wall Street. The Financial Accounting Standards Board already allowed banks to use models to value assets which did not have market data to base a valuation upon. The Federal Reserve and Treasury “convinced” the limp wristed accountants at the FASB to fold like a cheap suit. The FASB changed the rules so that when the market prices were not orderly, or where the bank was forced to sell the asset for regulatory purposes, or where the seller was close to bankruptcy, the bank could ignore the market price and make up one of its own. Essentially the banking syndicate got to have it both ways. It drew all the benefits of mark to market pricing when the markets were heading higher, and it was able to abandon mark to market pricing when markets went in the toilet.

“Suspending mark-to-market accounting, in essence, suspends reality.” – Beth Brooke, global vice chair, at Ernst & Young

Wall Street desired all the billions of upside from creating new markets for new products. Their creativity knew no bounds as they crafted MBOs, MBSs, CDOs, CDSs, and then chopped them into tranches, selling them around the world with AAA stamps of approval from the soulless whore rating agencies. When the net result of a flawed system of toxic garbage paper was revealed, there was no room at the exits for the stampede of investment bankers. The toxic paper was on the banks’ books and no one wanted to admit the greed induced decision to purchase these highly risky, volatile “assets”. The trade had not gone bad, the ponzi scheme had unraveled. Suspending FASB 157 has been an attempt to hide this fraudulent business model from investors, regulators and the public. By hiding the true value of these assets, the financial system has never cleared. The banks remain in a zombie vegetative state, with the Federal Reserve providing the IV and the life support system.

Let’s Play Hide the Losses

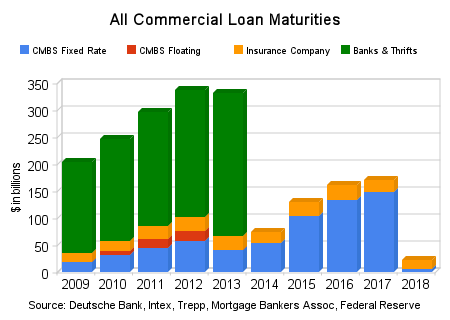

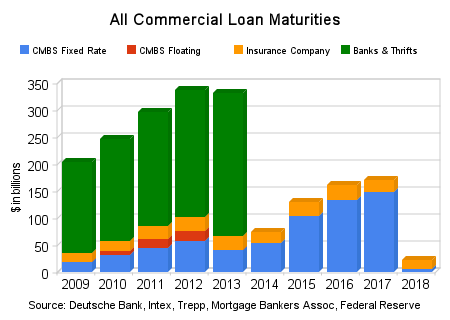

Part two of the master cover-up plan has been the extending of commercial real estate loans and pretending that they will eventually be repaid. In late 2009 it was clear to the Federal Reserve and the Treasury that the $1.2 trillion in commercial loans maturing between 2010 and 2013 would cause thousands of bank failures if the existing regulations were enforced. The Treasury stepped to the plate first. New rules at the IRS weren’t directly related to banking, but allowed commercial loans that were part of investment pools known as Real Estate Mortgage Investment Conduits, or REMICs, to be refinanced without triggering tax penalties for investors.

The Federal Reserve, which is tasked with making sure banks loans are properly valued, instructed banks throughout the country to “extend and pretend” or “amend and pretend,” in which the bank gives a borrower more time to repay a loan. Banks were “encouraged” to modify loans to help cash strapped borrowers. The hope was that by amending the terms to enable the borrower to avoid a refinancing that would have been impossible, the lender would ultimately be able to collect the balance due on the loan. Ben and his boys also pushed banks to do “troubled debt restructurings.” Such restructurings involved modifying an existing loan by changing the terms or breaking the loan into pieces. Bank, thrift and credit-union regulators very quietly gave lenders flexibility in how they classified distressed commercial mortgages. Banks were able to slice distressed loans into performing and non-performing loans, and institutions were able to magically reduce the total reserves set aside for non-performing loans.

If a mall developer has 40% of their mall vacant and the cash flow from the mall is insufficient to service the loan, the bank would normally need to set aside reserves for the entire loan. Under the new guidelines they could carve the loan into two pieces, with 60% that is covered by cash flow as a good loan and the 40% without sufficient cash flow would be classified as non-performing. The truth is that billions in commercial loans are in distress right now because tenants are dropping like flies. Rather than writing down the loans, banks are extending the terms of the debt with more interest reserves included so they can continue to classify the loans as “performing.” The reality is that the values of the property behind these loans have fallen 43%. Banks are extending loans that they would never make now, because borrowers are already grossly upside-down.

Extending the length of a loan, changing the terms, and pretending that it will be repaid won’t generate real cash flow or keep the value of the property from declining. U.S. banks hold an estimated $156 billion of souring commercial real-estate loans, according to research firm Trepp LLC. About two-thirds of commercial real-estate loans maturing at banks from now through 2015 are underwater. Media shills proclaiming that the market is improving, doesn’t make it so. The chart below details the delinquency rates from 2007 through 2010 as reported by the Federal Reserve:

| |

Real estate loans |

Consumer loans |

| All |

Booked in domestic offices |

All |

Credit cards |

Other |

| Residential |

Commercial |

| 2010 4th Qtr |

9.01 |

9.94 |

7.97 |

3.71 |

4.17 |

3.10 |

| 2010 3rd Qtr |

9.77 |

10.90 |

8.69 |

4.03 |

4.60 |

3.39 |

| 2010 2nd Qtr |

10.02 |

11.32 |

8.74 |

4.25 |

5.07 |

3.37 |

| 2010 1st Qtr |

9.78 |

10.97 |

8.66 |

4.63 |

5.76 |

3.48 |

| 2009 4th Qtr |

9.48 |

10.29 |

8.74 |

4.64 |

6.36 |

3.48 |

| 2009 3d Qtr |

9.00 |

9.67 |

8.57 |

4.72 |

6.51 |

3.61 |

| 2009 2nd Qtr |

8.19 |

8.69 |

7.84 |

4.85 |

6.75 |

3.69 |

| 2009 1st Qtr |

7.19 |

7.89 |

6.55 |

4.62 |

6.50 |

3.52 |

| 2008 4th Qtr |

5.99 |

6.57 |

5.49 |

4.29 |

5.65 |

3.37 |

| 2008 3rd Qtr |

4.88 |

5.26 |

4.66 |

3.73 |

4.80 |

3.05 |

| 2008 2nd Qtr |

4.21 |

4.39 |

4.15 |

3.55 |

4.89 |

2.80 |

| 2008 1st Qtr |

3.56 |

3.70 |

3.50 |

3.48 |

4.76 |

2.76 |

| 2007 4th Qtr |

2.89 |

3.06 |

2.75 |

3.41 |

4.60 |

2.66 |

| 2007 3rd Qtr |

2.40 |

2.78 |

1.98 |

3.20 |

4.41 |

2.48 |

| 2007 2nd Qtr |

2.01 |

2.30 |

1.63 |

2.99 |

4.02 |

2.37 |

| 2007 1st Qtr |

1.77 |

2.03 |

1.43 |

2.93 |

3.97 |

2.29 |

Delinquency rates on residential and commercial loans in early 2007 were in the range of 1.5% to 2.0%. Now the MSM pundits get excited over a decline from 8.7% to 8.0%. These figures show that even after trillions of Federal Reserve and Federal Government intervention, delinquencies remain four times higher than normal. In the real world, cash flow matters. Payment of interest and principal on a loan matters. Actual market values matter. According to Trepp, LLC, a data firm specializing in commercial data, non-performing commercial real estate loans makes up 72% of the $320 million in non-performing loans reported by banks in February. These figures are after the “extremely” relaxed definition of non-performing allowed by the Federal Reserve. The game is ongoing. Misinformation abounds. The SEC now issues press releases saying they are worried that banks are covering up losses, when they were involved in encouraging the banks to cover-up their losses. Last week the SEC announced they have become concerned that extend and pretend, along with another practice known as “troubled debt restructuring” that allows banks to break loans into pieces, may have been abused in order to diminish the volume of reserves banks are holding. What a shocking revelation. Who could have known?

Are You Smarter than a Wall Street CEO?

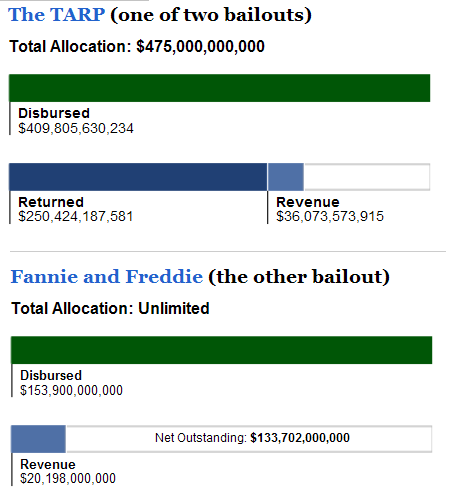

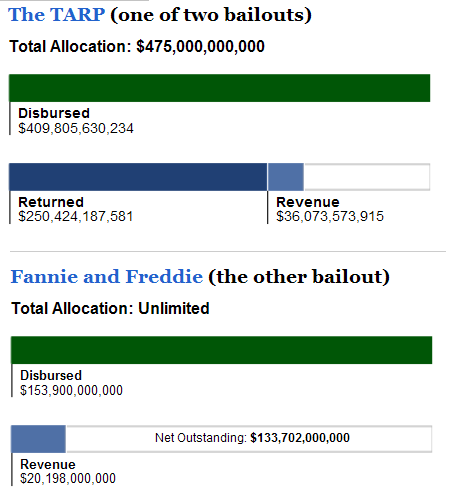

The Federal Reserve paid shills and Wall Street front men are out in droves declaring that TARP was a success and the banking system is recovering strongly. Columnists like Robert Samuelson declare TARP was a great investment and will profit the taxpayer. Samuelson says that the Treasury has recouped $244 billion of the $245 billion it invested in banks and that, when it winds down its last investments, it likely will show a $20 billion profit from the banks. This type of propaganda is ludicrous, as Barry Ritholtz succinctly points out:

“No, we are not profitable on the bailouts. TARP has $123B to go before breakeven, and the GSEs are $133B in the hole. All told, the Taxpayers have a long way to go before we are breakeven. That’s before we count lost income from savings, bonds, etc., the increased costs of food stuff and energy due to inflation (the Fed’s has done this on purpose as part of their rescue plan), the higher fees the reduced competition of megabanks has created, and the future costs our Moral Hazard will have wrought in increased risks and disasters.” – Barry Ritholtz

Source: Barry Ritholtz

Fannie Mae and Freddie Mac have hundreds of billions in bad loans sitting on their balance sheets. Their total cost to taxpayers will reach $400 billion, and never be repaid. The Federal Reserve has over $1 trillion in toxic assets on its balance sheet, off loaded by the TARP recipient banks in 2009. The taxpayer will never be repaid for this toxic waste. The government is implementing the Big Lie theory. If you tell a big lie often and loud enough, the non-thinking masses will believe it. That leaves us with today’s fantasy world.

The reality on the ground does not match the rhetoric coming from the government, Wall Street and the corporate mainstream media. The truth is as follows:

- The vacancy rate for office space in the U.S. is currently 16.5%.

- The vacancy rate for industrial space in the U.S. is currently 14.2%.

- The vacancy rate for retail space in the U.S. is currently 13%.

- Delinquencies within collateralized debt obligations in commercial real estate loans rose to 14.6% in February. The increase signals a trend of higher delinquencies in the segment. Signs of pressure surfaced as early as January when the delinquency rate on CDOs within commercial real estate loans hovered well above 13%.

- According to Moody’s, CRE prices are down 4.3% from a year ago and down about 43% from the peak in 2007.

- The delinquency rate on loans packaged and sold in commercial mortgage-backed securities rose to a record 9.2% in February, according to a March 15 report by Moody’s.

- Regional and local community banks have as much as 80% of their balance sheets tied up in commercial real estate, and very few other sources of significant fee income to offset CRE losses.

- CRE once had an estimated national value of $6.5 trillion. Today it stands at an optimistic $3.5 trillion.

- There are 1.8 million homes seriously delinquent, in the foreclosure process or REO that are not currently listed for sale.

- There are about 2 million current negative equity loans that are more than 50% “upside down”.

- Home prices are off 31.3% from the peak. The Composite 20 is only 0.7% above the May 2009 post-bubble bottom and will probably be at a new post-bubble low soon.

In the face of this data, mouthpieces for the Federal Reserve go before Congress and try to paint an optimistic picture. “While we expect significant ongoing CRE-related problems, it appears that worst-case scenarios are becoming increasingly unlikely,” Patrick Parkinson, the Federal Reserve’s director of banking supervision and regulation, told Congress. Parkinson said that since the beginning of 2008 through the third quarter of 2010, commercial banks had incurred almost $80 billion of losses from commercial real estate exposures. Banks are estimated to have taken roughly 40% to 50% of losses they will incur over this business cycle, he said.

The Federal Reserve will be forced by the Federal Courts to reveal the banks they have saved from failure since 2008 by funneling billions of practically interest free tax payer dollars into their hands. The Fed is expected to release this week documents related to discount window lending from August 2007 to March 2010, including the peak month of October 2008, when loans hit $111 billion. It will be revealed they kept alive hundreds of banks that should have died. Shockingly, the supposedly taxpayer protecting Dodd-Frank law exempts past discount window lending from an audit by the Government Accountability Office, that’s examining much of the central bank’s other crisis-era programs. That champion of the little people, Barney Frank, said such disclosures might have “a negative market effect. If people saw the data the next day, they come to the conclusion that the bank must be in trouble.” Openness and transparency are evidently grey areas for Mr. Frank. Despite the non-disclosures, free Fed bucks, accounting fraud and uninterested regulators, over 300 banks managed to go out of business in the last two years, essentially bankrupting the FDIC. Have no fear. The Treasury gave the FDIC an unlimited line of credit with your money.

It is fascinating that every Friday afternoon the FDIC announces approximately three bank failures. Steady as she goes. No panic. Just a slow trickle of failure. But the reality is much worse than the show. Despite the gimmicks of extending and pretending, there are 900 banks essentially insolvent sitting on the FDIC “Problem” list. This is after closing the 300 banks. There are at least a couple hundred billion of losses in the pipeline, to be funded by the American people/Chinese lenders. A critical thinking American might ask, if things are getting better, why does the number of troubled banks continue to rise week after week, month after month?

One year ago the website www.businessinsider.com listed the 10 major regional banks with the highest risk from commercial real estate loans. These 10 banks had $133 billion of commercial real estate loans on their books. Most, if not all, are still in business today. The fact is those real estate loans are worth 30% to 50% less than they are being carried on the books. A true valuation of these loans would put all 10 of these banks out of business. They are dead banks walking. In a world where transparency, honesty, and true free markets reigned supreme, these banks would pay for their poor risk taking choices. They would be liquidated and their assets would be sold off to banks that did not make horrific lending decisions. Failures would fail.

| Bank |

CRE Loans (bil.) |

% of Tier 1 Capital |

| NY Community Bank |

$22.0 |

915% |

| Wintrust Financial Corp. |

$3.4 |

419% |

| M&T Bank |

$20.8 |

378% |

| Synovus |

$11.2 |

376% |

| Wilmington Trust |

$4.0 |

369% |

| Marshall & Iisley |

$13.8 |

283% |

| Zions Bancorporation |

$13.4 |

253% |

| Regions Financial |

$28.3 |

218% |

| UMB Bank |

$1.3 |

156% |

| Comerica |

$14.3 |

97% |

How could anyone deny the world is back on track after examining the following chart?

It should warm your heart to know that Financial Profits have amazingly reached their pre-crash highs. All it took was the Federal Reserve taking $1.3 trillion of bad loans off their books, overstating the value of their remaining loans by 40%, borrowing money from the Fed at 0%, relying on the Bernanke Put so their trading operations could gamble without fear of losses, and lastly by pretending their future losses will be lower and relieving their loan loss reserves. The banking industry didn’t need to do any of that stodgy old school stuff like make loans to small businesses. Extending and pretending is much more profitable.

The big four of JP Morgan, Citigroup, Bank of America, and Wells Fargo should have undergone orderly bankruptcy liquidation in 2008. They took on a vast amount of leverage and a vast amount of risk. Their greedy bets went bad. In a true capitalist system, they would have failed. Instead, in our crony capitalist system, they were bailed out by taxpayers and continue to function as zombie banks pretending to be healthy. They reported profits of $34.4 billion in 2010. Every dime of these profits was generated through accounting entries that relieved their provisions for loan losses. These “brilliant” CEOs who virtually destroyed the worldwide financial system in 2008, looked into their crystal balls and decided their loan losses in the future would be dramatically lower. I’ll take the other side of that bet. I dug into their SEC filings to get the information in the chart below. Just the fact that Citicorp and Bank of America have still not filed their 10K reports after 3 months tells a story.

| Bank |

Source |

CRE |

Mortgages |

Credit Card |

Total Loans |

Loss Reserve |

% of Loans |

| JP Morgan |

12/31 10K |

$53,635 |

$174,211 |

$137,676 |

$692,927 |

$32,266 |

4.7% |

| Citicorp |

9/30 10Q |

$79,281 |

$209,678 |

$216,759 |

$654,311 |

$43,674 |

6.7% |

| Bank of America |

9/30 10Q |

$77,062 |

$394,007 |

$142,298 |

$933,910 |

$43,581 |

4.7% |

| Wells Fargo |

12/31 10K |

$129,783 |

$337,105 |

$22,375 |

$757,267 |

$23,022 |

3.0% |

These four “Too Big To Fail” bastions of crony capitalism have $340 billion of commercial real estate loans on their books. That’s a lot of extending and pretending. Just properly valuing those loans at their true market value would wipe out most of their loan loss reserves. I wonder if Vikrim and his buddies have noticed that home prices have begun to plunge again. Deciding to not foreclose on home occupiers that haven’t made a mortgage payment in two years is not a long term strategy. These four banks have $1.1 billion of outstanding mortgage debt on their books. I wonder what a 20% further decline in home prices will do to these loans. Throw in another half a billion of credit card loans to Americans being hammered by soaring energy and food prices and you have a toxic mix of future losses. These banks are gonna need a bigger boat.

The game of extend and pretend at the expense of the American working middle class is growing old. When this game is over, Wall Street will be looking for another bailout. The American people will not fall for the lies again. Wall Street’s oppression reeks of greed and disgrace. They are liars and thieves. They have pillaged and stolen all that was left to steal. I will be surprised if they get out alive.

Well you are my accuser, now look in my face

Your opression reeks of your greed and disgrace

So one man has and another has not

How can you love what it is you have got

When you took it all from the weak hands of the poor?

Liars and thieves you know not what is in store

There will come a time I will look in your eye

You will pray to the God that you always denied

The I’ll go out back and I’ll get my gun

I’ll say, “You haven’t met me, I am the only son”

Dust Bowl Dance – Mumford & Sons