“In reading The History of Nations, we find that, like individuals, they have their whims and their peculiarities, their seasons of excitement and recklessness, when they care not what they do. We find that whole communities suddenly fix their minds upon one object and go mad in its pursuit; that millions of people become simultaneously impressed with one delusion, and run after it, till their attention is caught by some new folly more captivating than the first.”

Charles Mackay, Extraordinary Popular Delusions and the Madness of Crowds

“Nations, like individuals, cannot become desperate gamblers with impunity. Punishment is sure to overtake them sooner or later.”

Charles Mackay, Extraordinary Popular Delusions and the Madness of Crowds

“Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, one by one.”

Charles Mackay, Extraordinary Popular Delusions and the Madness of Crowds

“Let us not, in the pride of our superior knowledge, turn with contempt from the follies of our predecessors. The study of the errors into which great minds have fallen in the pursuit of truth can never be uninstructive. As the man looks back to the days of his childhood and his youth, and recalls to his mind the strange notions and false opinions that swayed his actions at the time, that he may wonder at them; so should society, for its edification, look back to the opinions which governed ages that fled…

Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, one by one.”

Charles Mackay

“The primary purposes of the political pamphlets of the early 1700s were neither to enlighten nor educate the masses, but to incite partisan conversation and spread commensurate ideas. Facts were not permitted to fetter the views they espoused, and the restraints of objective journalistic credibility were discarded by pamphleteers bent on promoting subjective slant to an insatiable general public for whom political dissonance was an integral part of social interaction.”

Gavin John Adams, Letters to John Law

“In reading The History of Nations, we find that, like individuals, they have their whims and their peculiarities, their seasons of excitement and recklessness, when they care not what they do. We find that whole communities suddenly fix their minds upon one object and go mad in its pursuit; that millions of people become simultaneously impressed with one delusion, and run after it, till their attention is caught by some new folly more captivating than the first.”

Charles Mackay, Extraordinary Popular Delusions and the Madness of Crowds

“Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, one by one.”

Charles Mackay, Extraordinary Popular Delusions and the Madness of Crowds

If you prefer fake news, fake data, and a fake narrative about an improving economy and stock market headed to 30,000, don’t read this fact based, reality check article. The level of stupidity engulfing the country has reached epic proportions, as the mainstream fake news networks flog bullshit Russian conspiracy stories, knowing at least 50% of the non-thinking iGadget distracted public believes anything they hear on the boob tube.

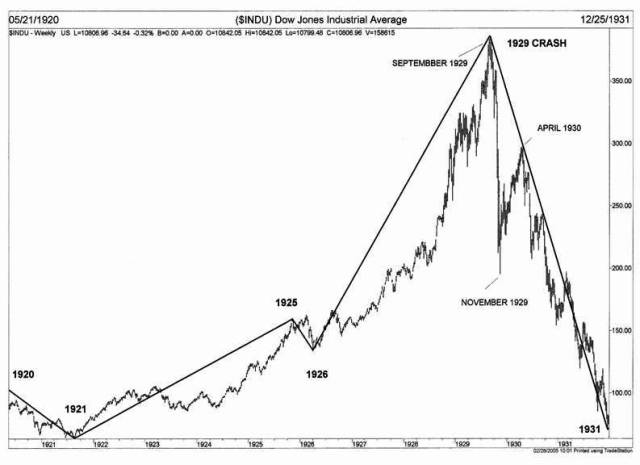

This stupendous degree of utter stupidity goes to a new level of idiocy when it comes to the stock market. The rigged fleecing machine known as Wall Street has gone into hyper-drive since futures dropped by 700 points on the night of Trump’s election. An already extremely overvalued market, as measured by every historically accurate valuation metric, soared by 4,000 points from that futures low – over 20% – to an all-time high. Despite dozens of warning signs and the experience of two 40% to 50% crashes in the last fifteen years, lemming like investors are confident the future is so bright they gotta wear shades.

The current bull market is the 2nd longest in history at 8 years. In March of 2009, the S&P 500 bottomed at a fitting level for Wall Street of 666. In a shocking coincidence, it bottomed on the same day Bernanke & Geithner forced the FASB to rollover like mangy dogs and stop enforcing mark to market accounting. Amazingly, when Wall Street banks, along with Fannie and Freddie, could value their toxic assets at whatever they chose, profits surged. The market is now 240% higher.

“The fall of Empire, gentlemen, is a massive thing, however, and not easily fought. It is dictated by a rising bureaucracy, a receding initiative, a freezing of caste, a damming of curiosity—a hundred other factors. It has been going on, as I have said, for centuries, and it is too majestic and massive a movement to stop.” – Isaac Asimov, Foundation

“Any fool can tell a crisis when it arrives. The real service to the state is to detect it in embryo.” – Isaac Asimov, Foundation

I read Isaac Asimov’s renowned award winning science fiction trilogy four decades ago as a teenager. I read them because I liked science fiction novels, not because I was trying to understand the correlation to the fall of the Roman Empire. The books that came to be called the Foundation Trilogy (Foundation, Foundation and Empire, and Second Foundation) were not written as novels; they’re the collected Foundation stories Asimov wrote between 1941 and 1950. He wrote these stories during the final stages of our last Fourth Turning Crisis and the beginning stages of the next High. This was the same time frame in which Tolkien wrote the Lord of the Rings Trilogy and Orwell wrote 1984. This was not a coincidence.

Continue reading “FOUNDATION – FALL OF THE AMERICAN GALACTIC EMPIRE”

Having recently finished reading The Harrows of Spring, the fourth and final novel of Jim Kunstler’s World Made By Hand series, I couldn’t help but compare and contrast his dystopian post economic collapse America versus our current warped egocentric pre-economic collapse America. His world made by hand is forced upon Americans who have survived some sort of conflict resulting in the destruction of Washington D.C. and Los Angeles by nuclear blasts.

The Federal government has ceased to exist. The nation has splintered and varied factions are vying for power in autonomous regions of the country, but the small community of Union Grove, New York has been left to fend for itself. The four novels detail the trials and tribulations of average Americans in a small rural town after the implosion of modernity, as the world is stripped of its technological oil based comforts, devastated by terrorism, racked by epidemics, and having endured the ravages of economic collapse.

Kunstler’s dystopian future isn’t as bleak as the dystopian visions of 1984 or Brave New World. If dystopian means a world characterized by dehumanization, totalitarian governments, environmental disaster, or a cataclysmic decline in society, then Kunstler’s World Made By Hand series doesn’t match that characterization. There is more humanity and hope in his novels than you would expect in a dystopian vision of the future. The novels focus on various types of societal segments who represent the different courses society could chart after a breakdown of modern social norms, enforced by central authorities. Living through a national catastrophe and stripped of the modern conveniences provided by cheap plentiful oil, the citizens of Union Grove see their community falling apart from neglect, natural decay, disease, and lack of hope for the future.

The stock market has reached new all-time highs this week, just two weeks after plunging over the BREXIT result. The bulls are exuberant as they dance on the graves of short-sellers and the purveyors of doom. This is surely proof all is well in the country and the complaints of the lowly peasants are just background noise. Record highs for the stock market must mean the economy is strong, consumers are confident, and the future is bright.

All the troubles documented by myself and all the other so called “doomers” must have dissipated under the avalanche of central banker liquidity. Printing fiat and layering more unpayable debt on top of old unpayable debt really was the solution to all our problems. I’m so relieved. I think I’ll put my life savings into Amazon and Twitter stock now that the all clear signal has been given.

Technical analysts are giving the buy signal now that we’ve broken out of a 19 month consolidation period. Since the entire stock market is driven by HFT supercomputers and Ivy League MBA geniuses who all use the same algorithm in their proprietary trading software, the lemming like behavior will likely lead to even higher prices. Lance Roberts, someone whose opinion I respect, reluctantly agrees we could see a market melt up:

“Wave 5, “market melt-ups” are the last bastion of hope for the “always bullish.” Unlike, the previous advances that were backed by improving earnings and economic growth, the final wave is pure emotion and speculation based on “hopes” of a quick fundamental recovery to justify market overvaluations. Such environments have always had rather disastrous endings and this time, will likely be no different.”

As Benjamin Graham, a wise man who would be scorned and ridiculed by today’s Ivy League educated Wall Street HFT scum, sagely noted many decades ago:

“In the short run, the market is a voting machine but in the long run, it is a weighing machine.”

You would think investors (muppets) would be grateful for the extended topping process of the stock market, as it has given them the opportunity to exit before the inevitable crash. As CNBC and the rest of the mainstream media spin bullish stories to keep the few remaining mom and pop investors sedated and the millions of passive working Americans invested in their 401ks, the Wall Street rigging machine siphons off billions in ill-gotten gains, while absconding with fees for worthless advice.

Does the average schmuck know the S&P 500 stood at 2,063 on November 21, 2014 and currently sits at 2,056, thirteen months later? Based on the media narrative, we are still in the midst of a raging bull market. John Hussman provides the counterpoint to this narrative with unequivocal factual evidence based upon a hundred years of stock market data and valuations. Anyone investing in today’s market should expect ZERO returns over the next ten years and a 40% to 55% plunge in the near future. And as a cherry on top, a recession has arrived.

The summary of this outlook is straightforward. I view the equity market as being in the late-stage top formation of the third financial bubble in 15 years. Based on a century of evidence relating the most historically reliable valuation measures to actual subsequent market returns, neither a market plunge of 40-55% over the completion of the current cycle, nor the expectation of zero 10-12 year S&P 500 nominal total returns, nor the likelihood of substantially negative 10-12 year real returns should be viewed as worst-case scenarios – they are all actually run-of-the-mill expectations from current extremes. Based on the joint behavior of the most reliable leading economic measures (particularly new orders plus order backlogs, minus inventories), widening credit spreads, and clearly deteriorating market internals, our economic outlook has also moved to a guarded expectation of a U.S. recession.

“Above all, don’t lie to yourself. The man who lies to himself and listens to his own lie comes to a point that he cannot distinguish the truth within him, or around him, and so loses all respect for himself and for others. And having no respect he ceases to love.” – Fyodor Dostoyevsky, The Brothers Karamazov

The lies we tell ourselves are only exceeded by the lies perpetrated by those controlling the levers of our society. We’ve lost respect for ourselves and others, transforming from citizens with obligations to consumers with desires. The love of mammon has left our country a hollowed out, debt ridden shell of what it once was. When I see the data from surveys about the amount of debt being carried by people in this country and match it up with the totals reported by the Federal Reserve, I’m honestly flabbergasted that so many people choose to live a lie. By falling for the false materialistic narrative of having it all today, millions of Americans have enslaved themselves in trillions of debt. The totals are breathtaking to behold:

Total mortgage debt – $13.6 trillion ($9.9 trillion residential)

Total credit card debt – $924 billion

Total auto loan debt – $1.0 trillion

Total student loan debt – $1.3 trillion

Other consumer debt – $300 billion

With 118 million occupied households in the U.S., that comes to $145,000 per household. But, when you consider only 74 million of the households are owner occupied and approximately 26 million of those are free and clear of mortgage debt, that leaves millions of people with in excess of $200,000 in mortgage debt. Keeping up with the Joneses has taken on a new meaning as buying a 6,000 sq ft McMansion with 3% down became the standard operating procedure for a vast swath of image conscious Americans. When you are up to your eyeballs in debt, you don’t own anything. You are living a lie.

“Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, and one by one.”

Charles Mackay, Extraordinary Popular Delusions and the Madness of Crowds, 1841

“In reading The History of Nations, we find that, like individuals, they have their whims and their peculiarities, their seasons of excitement and recklessness, when they care not what they do. We find that whole communities suddenly fix their minds upon one object and go mad in its pursuit; that millions of people become simultaneously impressed with one delusion, and run after it, till their attention is caught by some new folly more captivating than the first.”

Charles Mackay, Extraordinary Popular Delusions and the Madness of Crowds

“Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, one by one.”

Charles Mackay

“In reading The History of Nations, we find that, like individuals, they have their whims and their peculiarities, their seasons of excitement and recklessness, when they care not what they do. We find that whole communities suddenly fix their minds upon one object and go mad in its pursuit; that millions of people become simultaneously impressed with one delusion, and run after it, till their attention is caught by some new folly more captivating than the first.”

Charles Mackay

“Nations, like individuals, cannot become desperate gamblers with impunity. Punishment is sure to overtake them sooner or later.”

Charles Mackay

“Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, one by one.”

Charles Mackay, Extraordinary Popular Delusions and the Madness of Crowds

“In reading The History of Nations, we find that, like individuals, they have their whims and their peculiarities, their seasons of excitement and recklessness, when they care not what they do. We find that whole communities suddenly fix their minds upon one object and go mad in its pursuit; that millions of people become simultaneously impressed with one delusion, and run after it, till their attention is caught by some new folly more captivating than the first.”

Charles Mackay, Extraordinary Popular Delusions and the Madness of Crowds

“Nations, like individuals, cannot become desperate gamblers with impunity. Punishment is sure to overtake them sooner or later.”

Charles Mackay, Extraordinary Popular Delusions and the Madness of Crowds

“Of all the offspring of Time, Error is the most ancient, and is so old and familiar an acquaintance, that Truth, when discovered, comes upon most of us like an intruder, and meets the intruder’s welcome.”

Charles Mackay

“In February 1720 an edict was published, which, instead of restoring the credit of the paper, as was intended, destroyed it irrecoverably, and drove the country to the very brink of revolution…”

Charles Mackay, Extraordinary Popular Delusions and the Madness of Crowds

“In reading The History of Nations, we find that, like individuals, they have their whims and their peculiarities, their seasons of excitement and recklessness, when they care not what they do. We find that whole communities suddenly fix their minds upon one object and go mad in its pursuit; that millions of people become simultaneously impressed with one delusion, and run after it, till their attention is caught by some new folly more captivating than the first.”― Charles Mackay, Extraordinary Popular Delusions and the Madness of Crowds

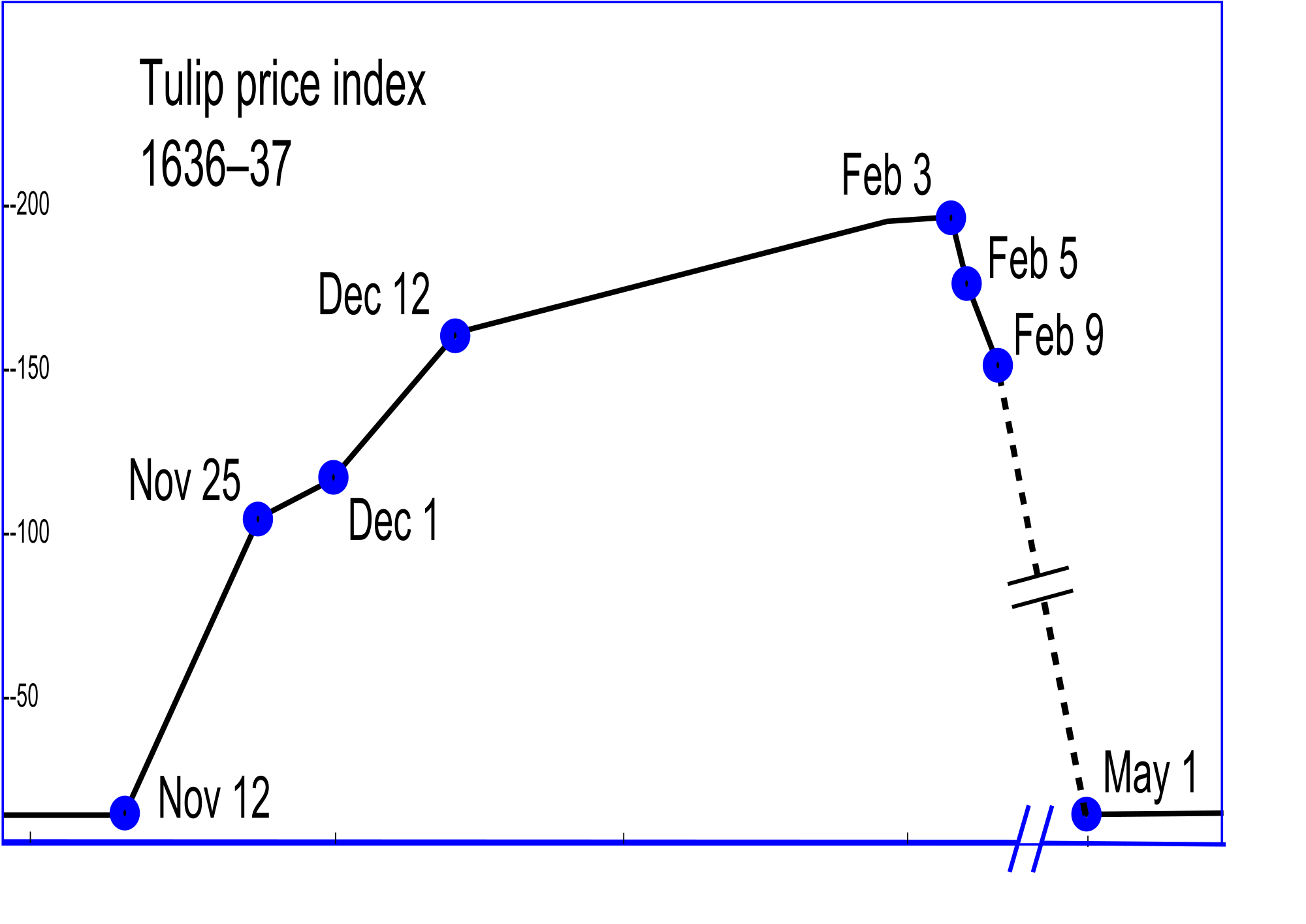

Human nature doesn’t change. It is the same across the world. We are driven by fear and greed. Overconfidence, lack of reason, poor math skills, herd mentality, and delusional thinking lead to bubbles. When the bubble reaches a tipping point, fear takes over and the herd all try to exit at the same time through a narrow pathway. The Crash ensues.

It happened in the 1600’s.

It happened in the 1700’s.

It happened in the 1800’s.

It happened in the 1920’s.

The Chinese real estate bubble has been imploding for the last year. The Chinese economy is barely growing at 1.6% after decades of 10% growth. There are millions of unoccupied condos. There are dozens of ghost cities and empty office towers. It’s the most corrupt nation on earth. We are in the midst of a global recession.It’s pure madness that the Chinese stock market would soar when its leading economic indicators crash to 2008 lows.

Its stock market has gone up 115% in the last 9 months. It has gone up 80% in the last 5 months. It has gone up 35% in the last month. Housewives and other uneducated gamblers have opened a record 10.8 million new stock accounts this year, more than the total number for all of 2012 and 2013 combined.

The Hong Kong stock market has gone up 14% in three weeks.

Since real estate investing is failing miserably, the Chinese middle class have piled into stocks on margin. Where have I seen that before? Margin debt on the Shanghai Stock Exchange climbed to a record 1.16 trillion yuan on Thursday. When has buying overvalued stocks on margin when the economy is tanking ever gone wrong before? Have we already forgotten 2000 and 2008? Humans truly act like irrational herds of cattle stampeding in whatever direction they are pushed by their keepers.