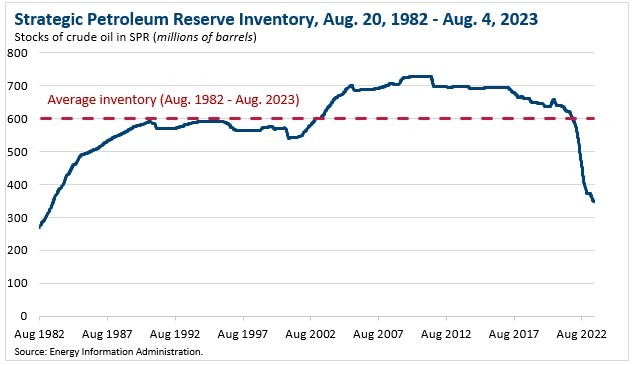

When gas prices soared above $4.00 per gallon in the summer of 2022, Pedo Joe decided to deplete our strategic petroleum reserve in order to bring prices down before the mid-term elections. Strategic has a different meaning to our Dementia Patient in Chief and his commie cohorts than it does to people who understand strategy. When you are trying to provoke China and one of the world’s biggest oil producers – Russia – into World War 3, it might be a good idea to keep your strategic reserves topped off. Instead it is at the lowest level since 1982, down 42% from its long-term average, with no plans to refill it.

Continue reading “BIDEN’S PRESIDENTIAL SUCCESS IN TWO CHARTS”

/pic307058.jpg)