“It is difficult to get a man to understand something, when his salary depends on his not understanding it.”― Upton Sinclair – I, Candidate for Governor: And How I Got Licked

“The U.S. financial markets had always been either corrupt or about to be corrupted.” – Michael Lewis, Flash Boys

I finished reading Michael Lewis’ Flash Boys take-down of Wall Street banks, hedge funds, government regulators and high frequency traders last week when I had spare time created by a weeklong denial of service attack on my website. It appears to me technology is being utilized more frequently as a mechanism for malevolence rather than a mechanism for good. The smartest guys in the room are figuring out ways to steal you blind in the financial markets, pilfer your personal information, spy on your electronic communications, and censor your right to free speech by taking away your ability to communicate freely on the internet. After reading Lewis’ maddening tome and experiencing the frustration of an attack that reached 50 million hits per day on my website, I’m reminded of two quotes from the brilliant dystopian visionary Aldous Huxley.

“Technological progress has merely provided us with more efficient means for going backwards.” ― Aldous Huxley – Ends and Means

“You shall know the truth and the truth shall make you mad.” – Aldous Huxley

Technology has been pushed on the masses like a drug by the mega-corporation and mega-media dealers. Just walk down any city street and observe the technologically entranced zombies shuffling along the sidewalks staring blankly at a tiny screen, tapping away on an itsy bitsy keypad as if whatever they are conveying is of vital importance to the future of mankind. # Give me a break. God forbid if we had to go out in public without our iGadget attached to an appendage. We might actually have to use our brain to think. We might be able to look someone in the eye and smile. We might be able to say hello to a stranger. We might have to act like a human being.

Being connected electronically 24 hours per day is not progress. The technology being peddled to the masses by mega-corporations is designed to keep people amused, apathetic, distracted and uninterested in thinking critically. Our society has devolved into a technologically narcissistic, ego driven, submissive, trivial culture, asphyxiating in a sea of irrelevance and driven by greed and need to fulfill our every desire, rather than a technologically proficient, selfless, humble, critical thinking, civil minded society of self-reliant human beings who take responsibility for their own lives and refuse to saddle future generations with the financial consequences of living beyond their means. Our willful ignorance, misuse of technology, and inability to control our impulses and desires will be the ruin of our perverted civilization.

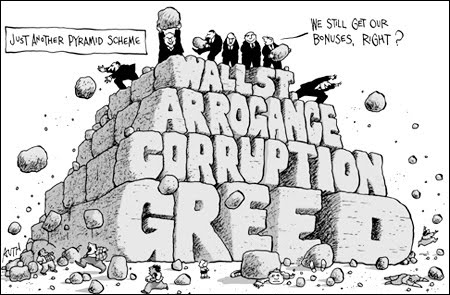

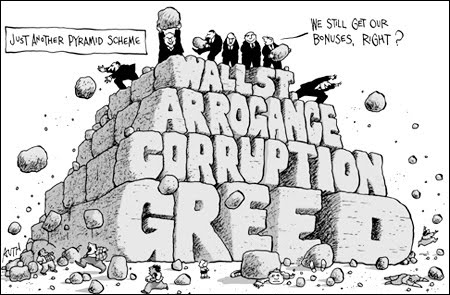

If the masses were capable of critical thinking and questioned the existing paradigm, they would conclude a small cadre of evil men has colluded to hijack the financial, political, and social systems in order to syphon off the nation’s wealth, while controlling the serfs through propaganda and luring them into debt servitude. Those who haven’t been brainwashed by media propaganda or amused to death by technology, are kept in check by thousands of laws, statutes, and regulations, enforced by millions of government bureaucrats and police state thugs. Technology is used by the state as a means of control, surveillance, censorship, and bilking the populace of their wealth. And if you don’t like it, the IRS, DHS, FBI, CIA, BLM, HHS, or some other three letter government agency will harass, arrest, fine, or kill you for not “cooperating”. And while the government is keeping you under their thumb, Wall Street shysters are stealing you blind.

The Truth Shall Make You Mad

“As soon as you realize that you are not able to execute your orders because someone else is able to identify what you are trying to do and race ahead of you to the other exchanges, it’s over. It really just pissed me off that people set out this way to make money from everyone else’s retirement account. I knew who was being screwed, people like my mom and pop, and I became hell-bent on figuring out who was doing the screwing.” – John Schwall – Flash Boys

As I continued reading Flash Boys I got progressively madder as more truth was revealed about the inner workings of Wall Street, the wasting of human intelligence on technological schemes to defraud the public, and the utter level of corruptness in the government agencies supposed to protect the public from the vultures in the financial industry feasting on the carcasses of dupes who still believe the “stocks for the long run” drivel regurgitated incessantly by the bimbos and slime balls on CNBC. The concepts of right and wrong, moral and immoral, honesty and dishonesty, and truth and lies are all purposefully blurred in shades of grey by those in power, in a blatant attempt to maintain and expand their vast wealth, immense power and complete governing control.

Michael Lewis focuses on our warped, rigged financial system, but his insights apply across the board to our entire society. Our economic, financial, political, regulatory, and judicial systems are all rigged. This serves the interests of the Deep State, Invisible Government, Oligarchs, Owners, or whatever other term you choose to describe the obscenely wealthy minority controlling this country. The existing establishment will never willingly change the system because it serves their myopic gluttonous interests.

“The deep problem with the system was a kind of moral inertia. So long as it served the narrow self-interests of everyone inside it, no one on the inside would ever seek to change it, no matter how corrupt or sinister it became.” – Michael Lewis – Flash Boys

Flash Boys is the fourth Michael Lewis book I’ve read. I had previously read Liar’s Poker, The Big Short, and Boomerang. He is a masterful storyteller. He has the ability to humanize complicated financial concepts and cut through the purposeful complexity built into the financial system to reveal the corruption, criminality and moral degradation of Wall Street bankers and Washington DC politicians. He slices through all the spin, misinformation, and mistruths flogged by Wall Street and their paid-off media mouthpieces to reveal everyone on Wall Street to be in on the action when it comes to fleecing their customers (muppets). The stench emanating from the bowels of Wall Street banks, hedge funds, and high frequency trading bucket shops hangs like toxic smog over our bloated fetid crony capitalist corpse of a country. This cast of despicable felonious characters, scalps investors day after day, with the insiders pretending all is well and the man on the street is being protected.

“The reason is that everyone is a bad actor. There’s an ecosystem that has risen up around a broken pipe on Wall Street. You have high-frequency traders who are scalping the market. They pay exchanges for the tools they need to scalp investors; the exchanges pay banks to essentially mishandle the stock orders so high-frequency traders can maximize the take. It’s a system designed to extract taxes from investors.” – Michael Lewis –Wired

The average person believes the stock market is run on free market principles, with willing buyers and sellers paying and receiving the most efficient price with regards to their transactions. The American people have put their trust in gargantuan bureaucratic government agencies, funded with their tax dollars, to protect their interests and fight for their rights in the financial marketplace. They innocently believe a private bank – The Federal Reserve – owned and controlled by the Too Big To Trust Wall Street Mega-Banks, is actually enforcing regulations and looking out for the best interest of the small investor. They evidently haven’t been paying attention for the last fourteen years, as the Federal Reserve has purposefully created bubble after bubble with ridiculously low interest rates, money printing on an epic scale, encouraging complete deregulation of banks, inciting speculation, and ignoring criminal behavior by their Wall Street owners.

After reading Lewis’ exposes about these Wall Street scumbags, you realize Scorsese’s seemingly over the top portrayal of these people in Wolves of Wall Street is accurate. Nothing has changed since Lewis worked at Salomon Brothers in the 1980’s. The people inhabiting that culture are unscrupulous, greedy, obtuse, ignorant, and intent upon preying on the weaknesses of their “clients”, who they hold in contempt. They are the wolves and you are sheep. The comforting picture of a stock broker representing your interests on a small commission basis has been replaced by stock exchanges colluding with Wall Street banks, hedge funds and high frequency traders to fleece mom and pop out of hundreds of billions on an annual basis using their super-fast computers located within the stock exchanges. The people who know the truth have no interest in drawing the new picture because their massive paychecks depend upon not drawing the picture.

You can tell how accurate a portrayal is by the reaction of those being portrayed. Flash Boys and the subsequent interview of Lewis by 60 Minutes resulted in a broad based assault by Wall Street bankers, HFT dirt bags, corrupt stock exchange CEOs, SEC lackeys, Federal Reserve Chairwomen, bought off politicians, faux financial journalists, sellouts like Buffett, and of course the mouthpieces of Wall Street on CNBC. The oligarchs benefitting immensely from the HFT scams, Dark Pool schemes, and Stock Exchange pay to play swindles, attempted to ambush the good guys (Brad Katsuyama and Michael Lewis) on CNBC, the captured media pawn of the Wall Street ruling elite.

CNBC stacked the deck against the good guys with the President of the BATS exchange, William O’Brien, given the task of shouting the loudest in an attempt to discredit the factual assertions made in the book. The BATS exchange was founded by high frequency traders and designed to foster the predatory schemes of high frequency trading firms who paid the exchange for the privilege of swindling investors. He went berserk on-air, accusing Brad Katsuyama of lying and denying that his firm purposefully allowed high frequency traders to front run slower orders from regular investors. I guess he thought rage, fury, screaming and false accusations would convince the hoi polloi of his innocence. He was wrong. The traders on the NYSE and in trading firms across Wall Street stopped trading to watch the contest on their screens. They would cheer every time Brad Katsuyama calmly responded with truth based facts.

Michael Lewis described the encounter shortly thereafter in an interview:

“The substantial shocker from this encounter is that Katsuyama tried to get O’Brien to admit that the BATS Exchange uses one very slow data feed to give investors the prices in the market, while selling, for vast sums of money, a faster feed to high-frequency traders, the effect being that the high-frequency trader knows the prices in the exchange before your order. So he has the privilege of trading against you at an old price if he wants to. And O’Brien says no that’s not true. He lied, on national television, about a central fact about his business.” – Michael Lewis –Wired

Under threat of prosecution, the BATS exchange had to admit its esteemed President blatantly lied on national TV. That seems par for the course when it comes to Wall Street executives. Deceitfulness, duplicity, and evasiveness are crucial requirements for the psychopaths occupying the corner offices in this warped world of high finance. The Wall Street Journal reluctantly revealed the truth:

BATS Global Markets Inc., under pressure from the New York Attorney General’s office, corrected statements made by a senior executive during a televised interview this week about how its exchanges work.

BATS President William O’Brien, during a CNBC interview Tuesday, said BATS’s Direct Edge exchanges use high-speed data feeds to price stock trades. Thursday, the exchange operator said two of its exchanges, EDGA and EGX, use a slower feed, known as the Securities Information Processor, to price trades.

The distinction matters because high-speed traders can use powerful computers and superfast links between markets to outpace traders and trading venues that rely on slower market data, such as the SIP.

Would the BATS Exchange have revealed the truth if they had not been pressured by the New York Attorney General to do so? Not bloody likely. Wall Street never admits guilt for any of its crimes, wrongdoings, misconduct, deceit or deceptions. They pay $1 billion in fines to their government co-conspirators as a public relations ploy, without admitting guilt and after reaping $10 billion of criminally generated profits. Not a bad ROI. The principles of right versus wrong, moral versus immoral, honesty versus dishonesty, and clarity versus opacity are willfully evaded by the titans of Wall Street and create no dilemmas for these greed driven psychopaths. Money and power are their drugs and the Federal Reserve is their dealer.

Michael Lewis books strike a chord with the public because he chooses a good guy hero his audience can empathize with. He played the sympathetic character in Liar’sPoker. Michael Burry, the brilliant Asperger’s Syndrome suffering investment genius, plays the role in The Big Short. And Brad Katsuyama, the mild mannered good hearted hobbit-like Canadian, takes on the evil forces of Mordor in Flash Boys. These characters all have something in common. They don’t fit in. They question the existing paradigm. They refuse to give in to the depraved culture permeating Wall Street. They exhibit an inner moral strength that enables them to resist the temptation of ill-gotten riches. And they don’t surrender their principles for a buck. This passage gives you a glimpse into the soul of Brad Katsuyama:

“In America, even the homeless were profligate. Back in Toronto, after a big bank dinner, Brad would gather the leftovers into covered tin trays and carry them out to a homeless guy he saw every day on his way to work. The guy was always appreciative. When the bank moved him to New York, he saw more homeless people in a day than he saw back home in a year. When no one was watching, he’d pack up the king’s banquet of untouched leftovers after the NY lunches and walk it down to the people on the streets. “They just looked at me like, ‘What the fuck is this guy doing?’” he said. “I stopped doing it because it didn’t feel like anyone gave a shit.” – Michael Lewis – Flash Boys

The apologists for the corrupt establishment attempted to trash Lewis and Katsuyama by contending the market has always been rigged and manipulated, therefore, the HFT embezzlement is just business as usual. Warren Buffett, king of oligarchs and apologist for the Wall Street billionaire club, assures the peasants the financial markets are fairer than ever. If Uncle Warren says it’s so to his girl Becky Quick on CNBC, how can anyone doubt him? It’s as if the supposedly mathematical genius billionaire forgot everything he learned in business school.

There is $21 trillion worth of U.S. stocks traded every year. Based upon Katsuyama’s analysis of how much high frequency traders, Wall Street dark pools, and the stock exchanges selling access were skimming on virtually every transaction, he estimated at least $160 million per day was being stolen from stock investors. That comes to a cool $40 billion per year, at a minimum. High frequency trading accounted for 25% of all stock trades in 2005. By 2008 high frequency traders accounted for 65% of all trades. They now account for in excess of 80% of all trading. The Ivy League educated Wall Street elite insist this extreme level of computer generated trading provides liquidity and efficiency for the markets. In reality, the actual trading results of the HFT firms, hedge funds and Wall Street TBTF banks prove the game is rigged. JP Morgan experienced ZERO trading loss days in 2013. Goldman Sachs, Morgan Stanley and most of the mega-banks have had virtually perfect daily trading results since 2010. If they are all winning, who is losing? Guess. Lewis provides further evidence of “investing” perfection:

“In early 2013, one of the largest high-frequency traders, Virtu Financial, publicly boasted that in five and a half years of trading it had experienced just one day when it hadn’t made money, and that the loss was caused by “human error.” In 2008, Dave Cummings, the CEO of a high-frequency trading firm called Tradebot, told university students that his firm had gone four years without a single day of trading losses. This sort of performance is possible only if you have a huge informational advantage.” – Michael Lewis – Flash Boys

Buffett, the financial “journalists” on CNBC, and all of the defenders of the Wall Street criminal cabal must have been asleep during their Stat class in college. The statistical probability of going four years or even four weeks without a losing trading day is as close to zero as you can get, unless the game is rigged and you are cheating. These results were not accomplished due to the brilliance of Wall Street big hanging dicks and their oversized brains. They were accomplished by front running stock market orders, bribing stock exchanges for first access, gaming the system with more powerful computers, ripping off clients in shadowy dark pools, and keeping the SEC at bay with promises of jobs and riches if they look the other way. This was all done under the veil of hyper-complexity designed to obscure, confuse, and cover-up the truth from unsuspecting investors.

And it is all done “legally” under the auspices of Regulation NMS, established by the SEC in 2007, to foster both competition among individual markets and competition among individual orders, in order to promote efficient and fair price formation across securities markets. As with almost every government regulation, law, or diktat, the new method of “protecting” the sheeple created fresh ways to fleece the sheeple by those who wrote the regulation. See Dodd-Frank and the Affordable Care Act. I don’t need a law or regulation to tell me the difference between right and wrong.

When obnoxiously wealthy pricks with the ability to bribe stock exchanges to place their trading computers on the floor of the exchange and financially induce the Wall Street banks to funnel trades through their dark pools in order to know what is happening a nanosecond before everyone else, and use this information to front run unknowing investors to generate risk free profits, it’s wrong. It really is black and white. I don’t care that it is supposedly “legal”. By complying with Regulation NMS the smart order routers of institutional investor firms like Vanguard, Fidelity and Schwab simply funneled naïve investors into various snares laid for them by the unscrupulous high frequency traders. The bad guys always win and the good guys always lose on Wall Street. And no one does anything because they are all on the take. Lewis puts it in terms the average person can understand.

“It was riskless, larcenous, and legal – made so by Reg NMS. The way Brad had described it, it was as if only one gambler were permitted to know the scores of last week’s NFL games, with no one else aware of his knowledge. He places bets in the casino on every game and waits for other gamblers to take the other side of those bets. There’s no guarantee that anyone will do so; but if they do, he’s certain to win.” – Michael Lewis – Flash Boys

If you aren’t mad yet, you will be after I go into the details of the regulatory capture, obscure deep pools within the bowels of the Too Big To Trust Banks, misuse of technology to defraud the public, and purposeful complexity built into the financial system to confuse and mislead the investing populace. I’ll tackle that in Part Two of this article.