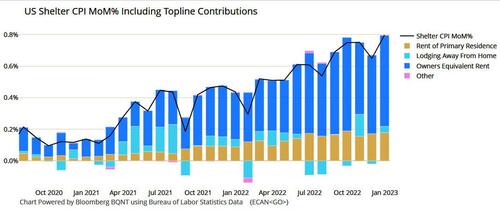

Two posts on ZH this morning tell you everything you need to know about Obama’s economy. Real wages are stagnant, just as they have been for the last eight years. In addition, the BLS drones are no longer able to hide the true inflation affecting average households across the nation. Even their “fake numbers” show inflation at 3.6% over the last four months. We know that is bogus, and the true number is in the 5% to 7% range for real Americans paying rent, health insurance premiums, heating their homes, and filling up their gas tanks.

But the Fed continues to keep rates near 0% so Goldman Sachs can report record earnings and average pay of $338,000 for their “doing God’s work” bankers. When you have no wage growth, while your expenses are rising rapidly, you’ve got STAGFLATION. It’s the worst possible economic situation for deplorables living in the real world outside the bastions of the elite in NYC, DC, LA and SF.

Numerous low, middle and high end retailers have reported atrocious holiday sales and earnings. This contrasts with the bullshit reports from the National Retail Federation and the US government saying holiday sales were solid. Kohls, Macys, Sears, and now Target have admitted their business absolutely sucks. They are closing stores, laying off employees, and slashing their earnings estimates. Does that happen when an economy is booming, as our esteemed president has been crowing about on his farewell tour?

Do you trust your government or do you trust the reality of your bank account and what real businesses operating in the real world are saying?

Continue reading “IT’S CALLED STAGFLATION”